Sterling decline against euro may end

2025-06-23

Summary:

Summary:

Sterling's slide against the euro may soon reverse as geopolitical risks and economic signals point to a potential EUR/GBP pullback.

The euro was hovering around its 2-month high against the pound on Monday after market mood darkened. US has joined Israel in attack on Iran and ushered in a new era of impunity.

The BOE kept its key interest rate on hold at 4.25% during its Thursday meeting, with economists expecting the central bank to wait until August before it cuts again.

The central bank warned that "global uncertainty remains elevated" as the escalation of the conflict in the Middle East has sent oil prices surging. That could undermine efforts to rein in inflation.

The country's consumer prices hit 3.4% in May, in line with economist expectations. The reading was still well above the 2% target, while the euro area has taken the lead in honouring the mandate to maintain price stability.

Trump signed an agreement earlier this month lowering some tariffs on imports from the UK, but the deal includes a 10% levy on most UK goods and did not address the expected removal of charges on steel imports.

EU negotiators are still pressing for the rate to be lower than 10%, said the European sources. The bloc has said publicly it will not settle for a double-digit baseline rate - as did the UK.

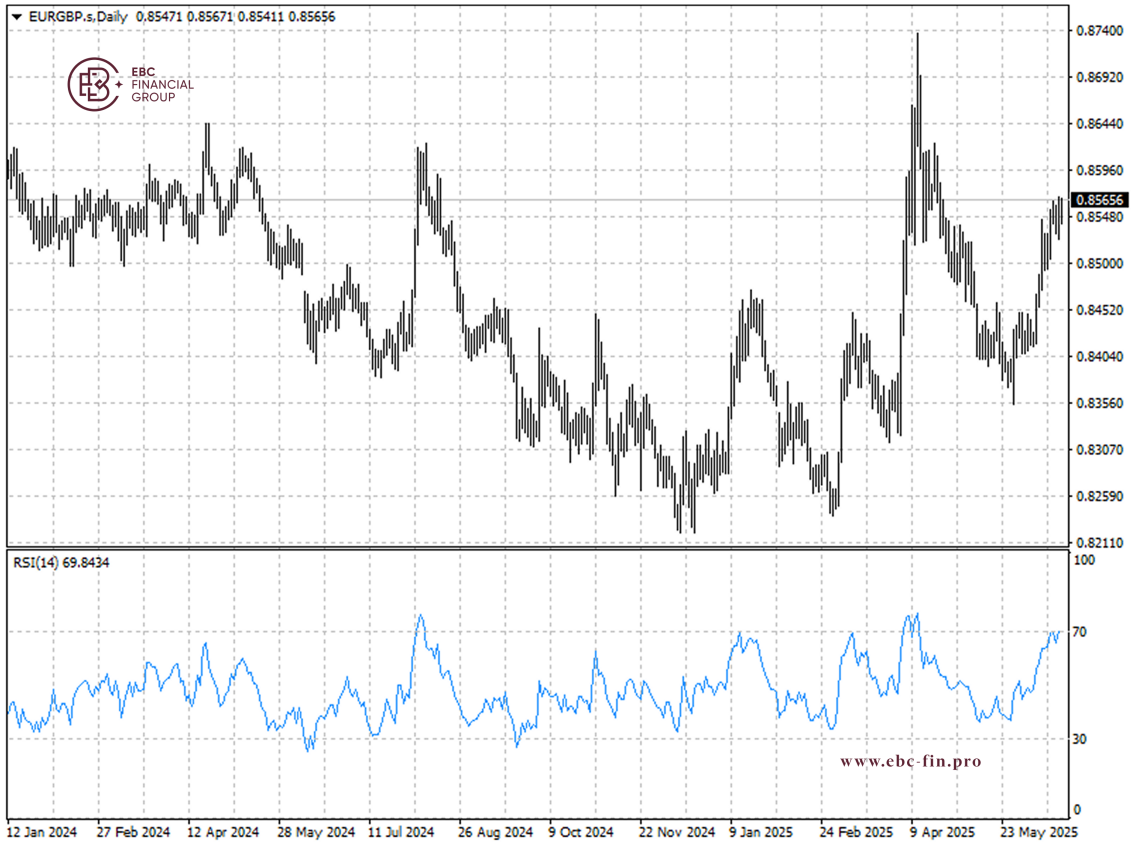

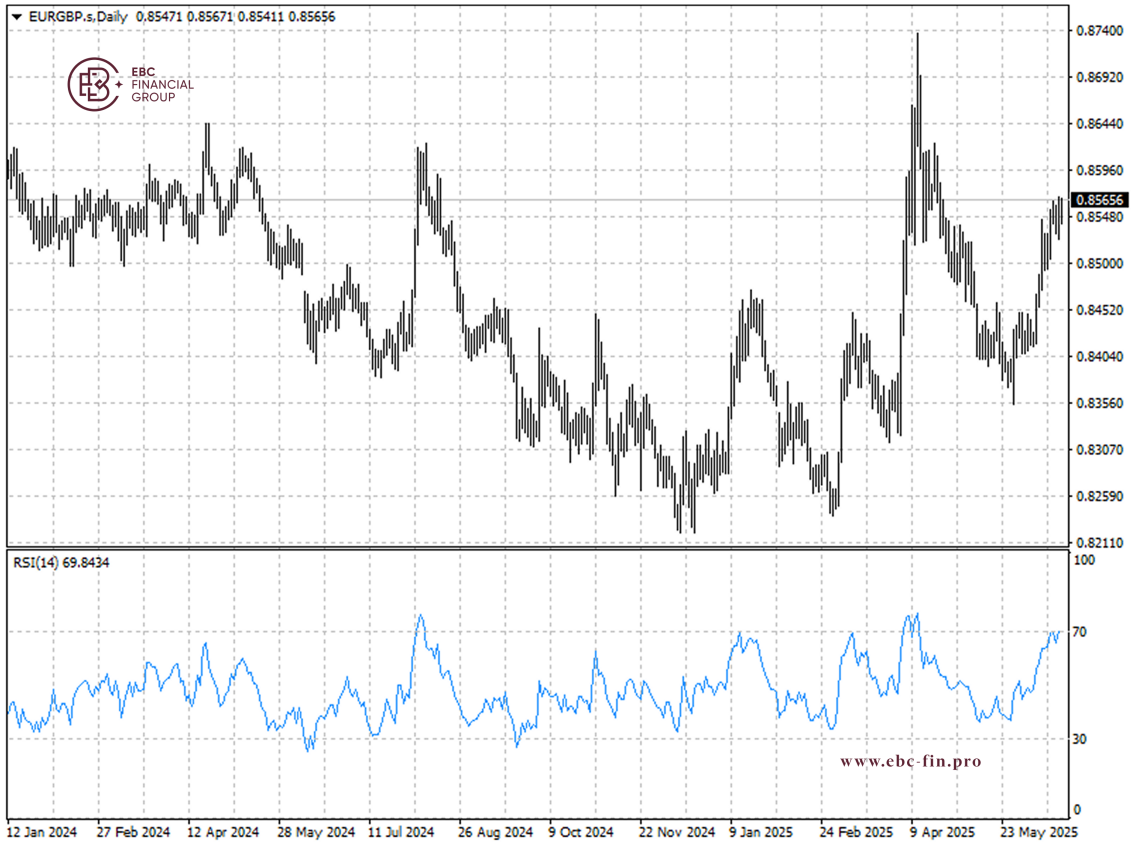

The RSI and economic fundamentals altogether signal a pullback is likely on the horizon for EUR/GBP. The initial support is seen to lie around 0.8500.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.