NASDAQ heats up as U.S. inflation cools

2023-05-11

Summary:

Summary:

The dollar remained stable on Wednesday as data showed inflation slowed slightly more than expected last month.

The dollar remained stable on Wednesday as data showed inflation slowed

slightly more than expected last month.

Gold saw some profit-taking and oil fell by more than a dollar as the Fed

might hike interest rates further.

The CPI rose 4.9% vs 5% expected in April from a year ago, below 5% for the

first time in two years.

A gauge of global stock markets rose and bond yields slid. The Nasdaq ended

at its highest intraday level in more than eight months.

Commodities

U.S. Crude Oil inventories rose by about 3 million barrels last week due to

another release from national reserves and a drop in exports, the EIA said.

U.S. gasoline inventories, however, fell by 3.2 million barrels last week,

much bigger than the 1.2 million-barrel draw forecast.

‘We are forecasting that oil prices range from $75-95 during 2023 based on

fundamental supply and demand and that oil will rally as we head into the summer

driving season,’ said Jay Hatfield, CEO of Infrastructure Capital

Management.

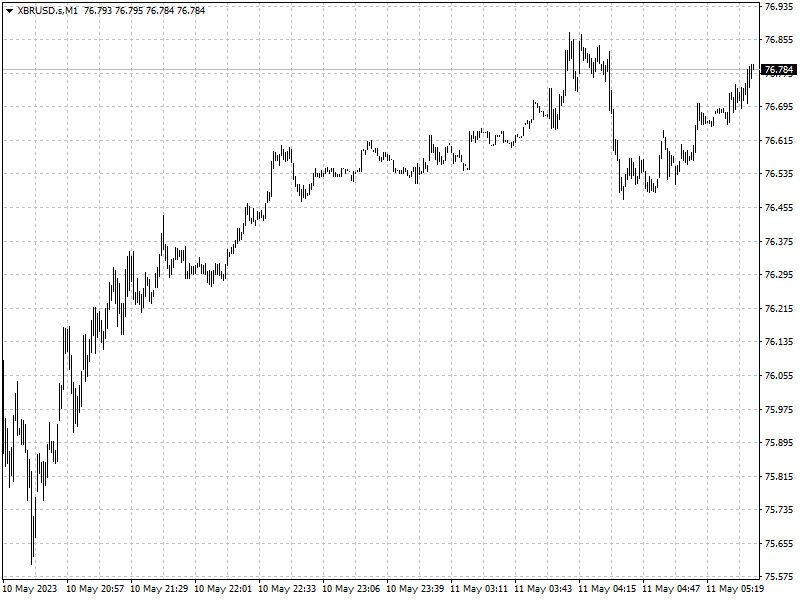

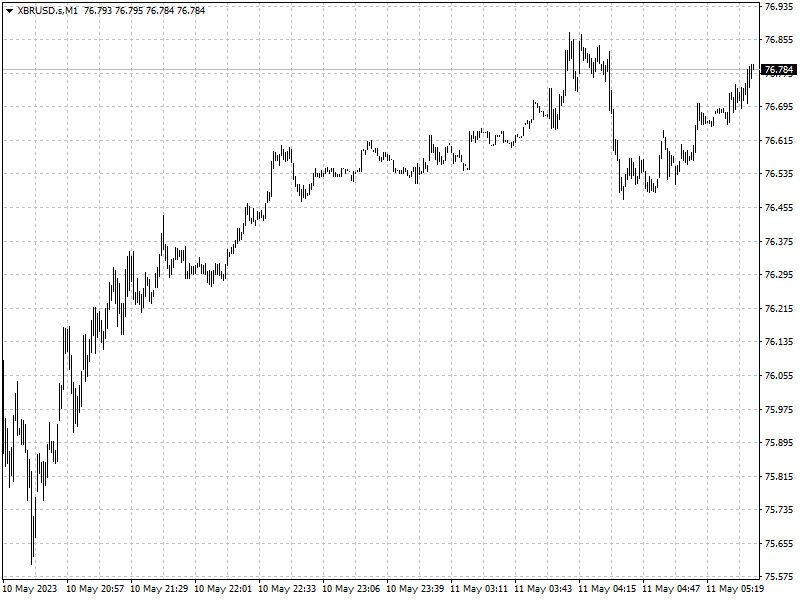

Forex

FX markets had been treading water while markets weighed policymakers'

rhetoric against traders' conviction that U.S. interest rates should fall.

Fed funds futures traders are pricing in a pause before expected rate cuts in

September. The Fed's target range stands at 5% to 5.25%.

But Amo Sahota, director at Klarity FX in San Francisco, believes the near

80-basis-point cut that markets are pricing in by the end of this year ‘looks a

little aggressive’.