In the ever-evolving world of investing, few phenomena have captured the public's imagination—and sparked as much controversy—as meme stocks. These aren't your typical blue-chip companies or steady dividend payers. Instead, these stocks are a product of the internet age, driven by social media hype, online communities, and a dash of rebellion against traditional finance. If you've heard of GameStop, AMC, or Bed Bath & Beyond, you've already dipped your toes into the meme stock universe. But what exactly are meme stocks, why do they matter, and should you consider investing in them?

What Are Meme Stocks?

Meme stocks are, at their core, stocks that gain popularity not because of their financial fundamentals, but because of their viral appeal on social media platforms. The term "meme" refers to their internet-driven nature, where jokes, memes, and collective enthusiasm propel these stocks into the spotlight. Unlike traditional investments, where decisions are based on earnings reports, revenue growth, or market trends, such stocks often rise (and fall) based on the whims of online communities like Reddit's WallStreet Bets.

Some of the most famous meme stocks include GameStop (GME), AMC Entertainment (AMC), and Bed Bath & Beyond (BBBY). These companies, often struggling or overlooked by traditional traders, became the darlings of retail traders who saw an opportunity to challenge Wall Street norms. The result? A wild ride of soaring Stock Prices, dramatic crashes, and a new chapter in the history of investing.

The Rise of Meme Stocks

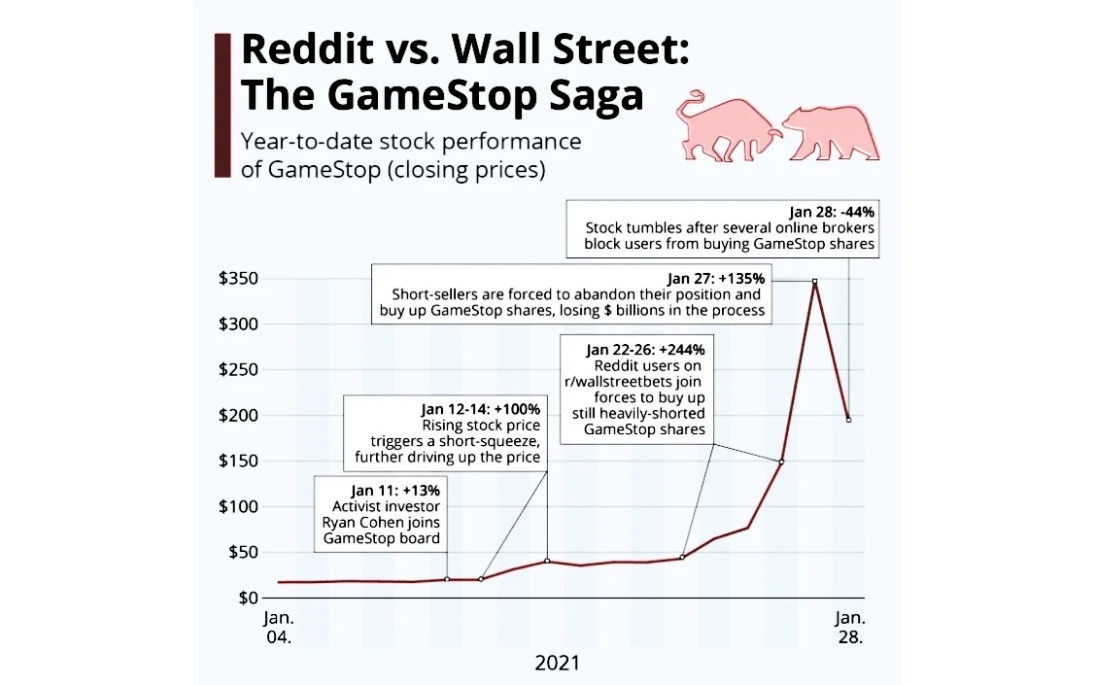

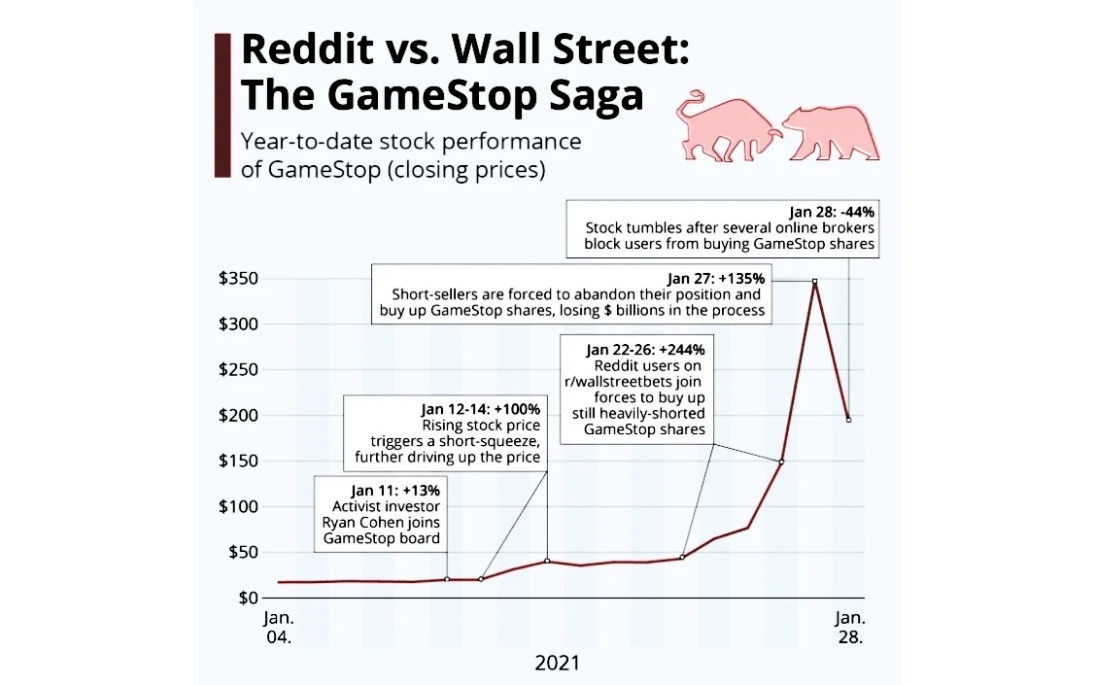

The meme stock phenomenon didn't happen overnight. It was the perfect storm of social media, accessible trading platforms, and a growing appetite for financial democratisation. In early 2021. Reddit's WallStreetBets community became the epicentre of this movement. Retail traders, many of them new to trading, banded together to drive up the prices of heavily shorted stocks like GameStop.

Short-selling, a practice where traders bet against a stock's success, played a key role in this saga. Hedge funds had heavily shorted GameStop, expecting its price to fall. But when retail traders started buying en masse, the stock's price skyrocketed, forcing short-sellers to cover their positions in a frenzy known as a "short squeeze." This sent GameStop's stock price to unprecedented levels, turning it into a symbol of retail trader power.

Platforms like Robinhood also played a significant role. With their user-friendly interfaces and commission-free trading, they made it easier than ever for everyday people to participate in the stock market. Suddenly, investing wasn't just for Wall Street professionals—it was for anyone with a smartphone and an internet connection.

Platforms like Robinhood also played a significant role. With their user-friendly interfaces and commission-free trading, they made it easier than ever for everyday people to participate in the stock market. Suddenly, investing wasn't just for Wall Street professionals—it was for anyone with a smartphone and an internet connection.

In 2025. such stocks are still very much a part of the stock market landscape, and their appeal has not diminished. The question for traders now is: which of these stocks are worth considering in this volatile market?

Why Meme Stocks Matter

Meme stocks are more than just a financial trend; they represent a cultural shift in how we think about investing. For decades, the stock market was dominated by institutional traders and hedge funds. Retail traders were often seen as small players with little influence. These stocks flipped this narrative on its head, proving that collective action by ordinary people could disrupt even the most entrenched financial systems.

This movement also highlighted the power of social media in shaping market behaviour. Platforms like Reddit, twitter, and TikTok became hubs for financial discussion, where memes and jokes could drive real-world investment decisions. For many, meme stocks became a way to stick it to the "big guys" on Wall Street, turning investing into a form of activism.

However, meme stocks also raised important questions about market fairness and regulation. Should retail traders have the same tools and information as institutional players? How can regulators ensure a level playing field in an age of viral trends and instant communication? These are questions that will likely shape the future of investing.

Risks and Challenges of Investing in Meme Stocks

While meme stocks can be thrilling, they come with significant risks. Their prices are often driven by hype and speculation rather than solid financial fundamentals. This makes them highly volatile, with prices that can swing dramatically in a matter of hours. For every trader who made a fortune on GameStop, there are others who lost money when the bubble burst.

Another challenge is the lack of predictability. Traditional traders rely on data and analysis to make informed decisions, but meme stocks often defy logic. A company with declining revenues and mounting debt can suddenly become a market darling simply because it's trending online. This makes it difficult to assess the true value of a meme stock and increases the likelihood of financial losses.

Finally, there's the risk of getting caught up in the hype. It's easy to be swept away by the excitement of a viral stock, especially when stories of life-changing gains dominate the headlines. But investing based on emotion rather than research is a recipe for disaster.

The Future of Meme Stocks

So, what's next for meme stocks? While their popularity may ebb and flow, the underlying forces that drove their rise—social media, accessible trading platforms, and a desire for financial democratisation—are here to stay. However, the landscape is likely to evolve.

Regulators are paying closer attention to the meme stock phenomenon, and new rules could be introduced to address concerns about market manipulation and fairness. At the same time, companies that became meme stocks are adapting to their newfound fame, with some using the opportunity to strengthen their businesses.

For traders, the key is to stay informed and adaptable. Meme stocks may be unpredictable, but they've also opened up new possibilities for how we think about investing. Whether you see them as a passing fad or a lasting shift, one thing is clear: they have changed the game.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Platforms like Robinhood also played a significant role. With their user-friendly interfaces and commission-free trading, they made it easier than ever for everyday people to participate in the

Platforms like Robinhood also played a significant role. With their user-friendly interfaces and commission-free trading, they made it easier than ever for everyday people to participate in the