What is market correlation analysis

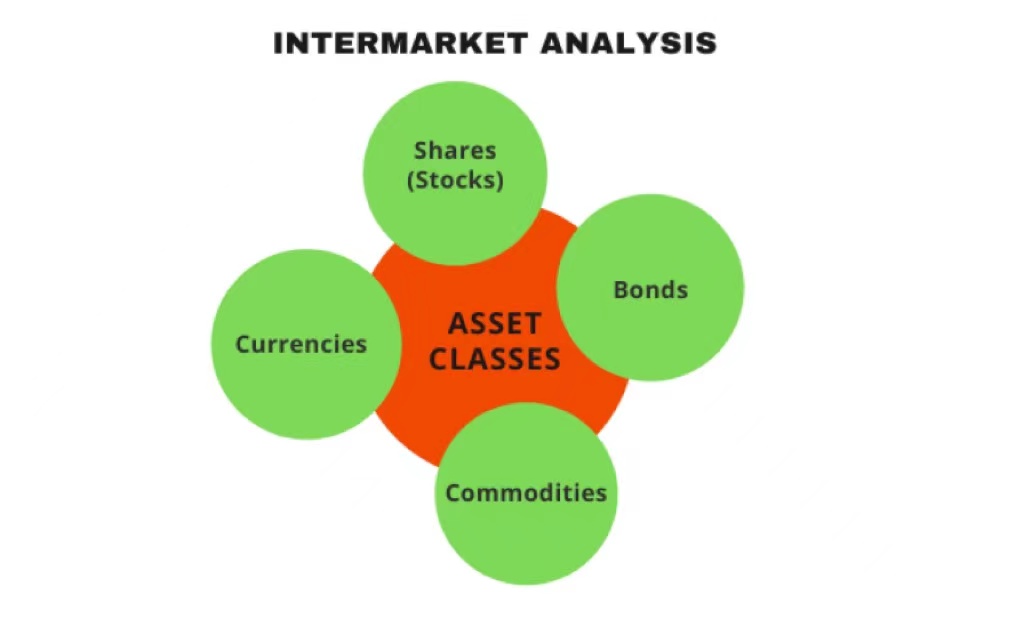

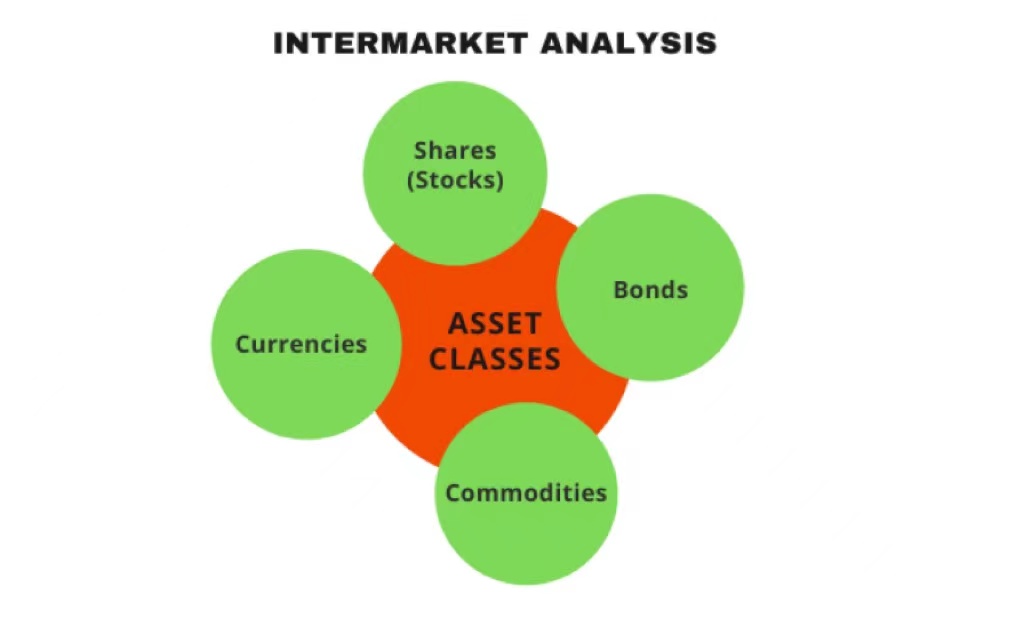

Market correlation analysis aims to identify the "correlations" between different markets or asset classes such as bonds, stocks, currencies, and commodities. No economy operates independently, and every market is influenced by what happens in another market. Due to the fact that financial instruments such as gold, Crude Oil, and bonds are considered good "asset targets", any changes in these will affect the foreign exchange market, and the internal dynamics of the foreign exchange market will in turn affect these markets.

The basic method for conducting correlation analysis is to first identify the investment target that you are interested in, and then analyze other asset classes that have a strong correlation with it.

For example, if you are conducting research on the US market, you can focus on the US bond market, commodity market, and currency market. As commodities are raw materials, any fluctuations or fluctuations in commodities will definitely have an impact on the US capital market, helping investors determine the future trajectory of the stock market. Market correlation analysis is considered a part of fundamental analysis because it depicts the interrelationships between markets and provides a sense of direction, rather than specific points or profit and loss forecasts.

Basic Principles

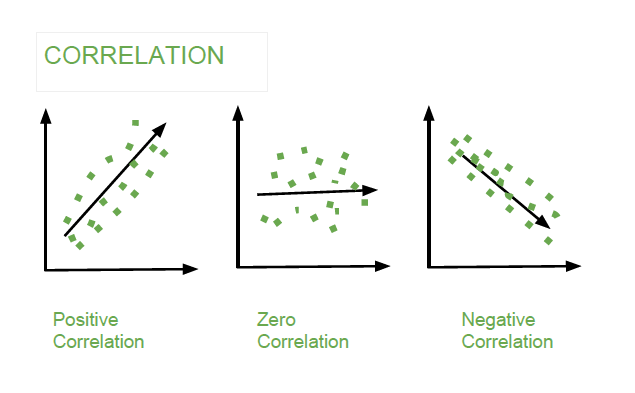

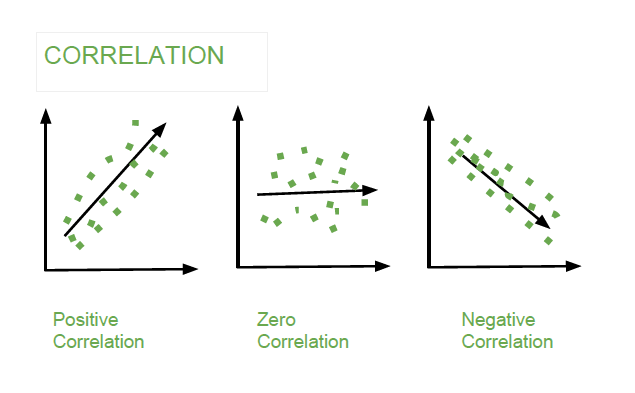

Market correlation analysis is easy to understand. We can put relevant targets into spreadsheets or chart platforms, and then calculate the correlation between them. According to the rule, a value of+1.0 indicates complete correlation, while a value of -1.0Indicates a completely negative correlation. If the value is' 0 ', it indicates that there is no correlation between these assets.

It is very rare for any two different asset classes to be completely correlated over a long period of time, so the common practice among experts is that any reading maintained at+0.7 or below -0.7 level has statistical significance. However, if the trajectory of the correlation changes from "positive" to "negative", the relationship will be considered "unstable".

Most of the time, investors subconsciously use it, for example, Stock Prices and loan interest rates are generally negatively correlated; Gold is a good substitute in the money market.

For example, due to external events such as the US China trade war, instability in the Middle East, or the Russia Ukraine war, which have led to increased volatility in the currency and stock markets, many investors have started to flee the foreign exchange market and flock to safe havens such as buying gold.

Market correlation analysis: gold and currency markets

gold trading and investment have existed for centuries. In the past, gold coins existed as a form of currency, but people gradually stopped this view and began to use gold as an investment tool in their portfolios. Precious metals have since held high value in the minds of investors. During periods of market turmoil, gold has become the safest investment target, and this special precious metal has never disappointed its investors. Next, this article will discuss the relationship between gold and some typical currency pairs as an example.

Gold and AUD/USD

In short, there is generally an inverse relationship between precious metal gold and the US dollar. When global financial market turmoil intensifies and investors begin to seek some kind of stable investment target, they often choose this kind of hedged asset - gold. On the contrary, when the economy is sound and operates in a stable market, people tend to invest in the US dollar.

As is well known, the australian dollar is a currency, which means its value is severely affected by the commodity industries operating in Australia, especially gold. Australia is fortunate to have the best gold mines on Earth, and the gold bullion extracted from Australia is larger than any other gold bullion found in the world. Currently, there are 66 operating gold mines in the country, including the world's largest 14. Nowadays, Australia can extract approximately $5 billion worth of gold annually.

As shown in the figure, there is a positive correlation between gold and AUD/USD

From the above figure, it is clear that gold is positively correlated with the Australian dollar/US dollar currency pair. When gold prices rise, the Australian dollar/US dollar pair also tends to rise. When gold prices fall, the AUD/USD currency pair also falls. From statistical data, the correlation between the Australian dollar/US dollar and gold prices is as high as+0.8 or 80%. It represents a strong correlation between the Australian legal tender and non yield safe haven gold.

Gold and USD/CHF

As is well known, the Swiss franc is the legal tender of Switzerland and Liechtenstein. Although Switzerland is a highly developed economy that relies on its strong financial industry, gold also plays an important role in the Swiss economy. Unlike Australia, Switzerland does not have as many gold mines, but fortunately, most of the world's gold passes through Switzerland.

Switzerland imports crude gold and refines it to achieve the highest purity in the world, increasing its value. According to global market conditions, this is a business worth 70 to 90 billion Swiss francs (70 to 90 billion US dollars) annually. The country processes 70% of the world's unrefined gold. Most of the gold arriving at Swiss refineries comes from the UK, the United Arab Emirates (UAE), and Hong Kong. Moreover, four of the nine major participants in the world's gold industry operate in Switzerland.

The above figure shows the close connection between gold and the US dollar/Swiss franc

Gold accounts for 63% of UK exports to Switzerland, 92% in the UAE, and 78% in Hong Kong. These are the three major gold exporting countries that do not produce gold themselves. Switzerland also purchases gold from Burkina Faso, Ghana, and Mali, which rely on gold as their largest export product. In order to better understand the important role of gold in the Swiss economy, Switzerland imported 2404 metric tons of gold worth 67 billion Swiss francs in 2017. In other words, 24% of Swiss exports and 31% of imports in 2017 were directly related to gold. So, we can see how important the role of gold is in the entire Swiss economy.

It is also important that according to Swiss law, the authorities should support a 25% gold currency to maintain high demand for gold in the Swiss economy. Gold is negatively correlated with the US dollar/Swiss franc currency pair. When the value of gold skyrockets, the US dollar/Swiss franc will fall. When the value of gold plummets, the US dollar/Swiss franc will rise.

In fact, most traders know that in general, when the US dollar falls, gold rises, while when gold falls, the US dollar often rises. Gold and the US dollar have a negative relationship for most of the year.

Why is there such a strong correlation between gold prices and the US dollar? There are three main reasons: firstly, the US dollar is the cornerstone of the current international monetary system, and both the US dollar and gold are the most important reserve assets of countries around the world. Therefore, as long as the US dollar is strong and stable, it will weaken the status of gold as a reserve asset and a hedging function; Secondly, the GDP of the United States still accounts for 1/4 of the world's GDP, and the total foreign trade volume has long ranked first in the world. The world economy is deeply affected by it, so the gold price is naturally inversely proportional to the quality of the world economy; Thirdly, the world gold market is generally priced in US dollars, so the depreciation of the US dollar will inevitably lead to an increase in gold prices.

Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.