Many people will see 1990 as the starting point for the development of the domestic financial market.

On October 26, 1990, the Shanghai Stock Exchange was established; On December 1st of the same year, the Shenzhen Stock Exchange also began operating; Afterwards, Yang Wanwan and Lao Bagu became the eternal marks of that surging years. But if we trace back to the origin, during the same period from 1980 to 1990, many Hong Kong forex brokers opened offices in Shanghai, which also marked the beginning of domestic forex trading.

Just thirty years have passed, and compared to the stock market, the domestic forex market is still in its infancy. Where are the differences in fate? What stage must China's forex market development go through?

1、 Looking at the Forex Market from the Development of the Stock Market

When it comes to China's investment market, we cannot bypass the stock market. But the development of the Chinese stock market was not achieved overnight.

In 1984, when China's first stock, Feile Audio, was born, many people had no idea what a stock was. Some people bought it sporadically and also kept it as a stamp collection. But later that year, the Jing'an Branch of Industrial and Commercial Bank of China's Hisense Trust Investment Company directly opened a counter to act as an agent for buying and selling stocks of Feile Sound, and later added Yanzhong Industry.

Over time, everyone knows that stocks can receive dividends, and the enthusiasm for buying has gradually increased. By the establishment of the Shanghai Stock Exchange in 1990, stock trading had finally become a natural investment method.

In July 1991, the Shanghai Stock Exchange launched a stock account, which finally solved the problem of being unable to directly buy and sell stocks outside of Shenzhen and Shanghai. In 1992, after the speech of the Southern Expedition, the Chinese stock market also experienced an expansion.

Throughout the development history of China's stock market, it is actually a process of continuously discovering and solving problems. Investors never understand and gradually understand, and then consider stocks as a daily investment method, which is also a gradual and gradual process.

2、 The forex market is a microcosm of the stock market 15 years ago

The forex market, which started at the same time as the stock market, also experienced the same process from the beginning.

In the 1980s and 1990s, the earliest forex brokerage companies that entered Shanghai were able to provide users with a complete set of account opening and trading procedures. Even for a period of time, forex and the stock market synchronized and became very active investment markets.

However, due to the lack of understanding of the forex market and forex trading among domestic traders at that time, coupled with the fact that the financial market was just starting, there was a lack of forex professionals, and the regulatory system was still in the exploratory stage. As a result, the sudden cessation of forex margin trading in 1994 also put a sharp brake on the development of the forex market.

From 1994 to 2006, the domestic forex margin market was basically in a blank stage, invisibly creating a 10-15 year gap between the forex market and the stock market.

However, with the maturity of domestic financial regulation, especially the establishment of the State Administration of Financial Supervision, the active forex market is on the eve of explosive development.

3、 The forex market will give birth to a group of influential traders

In the early stages of the development of the domestic stock market, a group of trading giants emerged, which played a very good demonstration and driving role in the development of the domestic stock market. For example, we are familiar with Yang Wanwan, Jiang Yiqun, and others.

At this time overseas, Bill Lipshutz earned $300 million in the foreign exchange department of Solomon Brothers; Andrew Craig earned $300 million by accurately predicting the decline of the New Zealand dollar; Richard Dennis invested $2000 into $200 million.

However, in contrast, due to the relative lack of channels in the domestic foreign exchange market, there are few influential figures.

The development of any market cannot do without demonstration effects. After years of exploration, the tracking platform has become a gathering place for domestic investors to share their experience and wisdom - traders synchronize their trading records with the tracking community, where investors can see their trading varieties and returns, and decide whether to follow.

In my opinion, the tracking community is the place where influential foreign exchange traders are most likely to emerge in the future.

Because the tracking community is open and transparent, the profitability and trading style of traders are clear at a glance, and the outstanding individuals have gradually become charismatic legendary figures in the community.

Unfortunately, due to the mechanism issues in the tracking community, most traders do not have direct monetization channels, which indirectly affects the effectiveness of signals; In addition, the vast majority of communities do not come from professional trading platforms and are unable to publicly display every order, resulting in data only remaining at the profit and loss level and unable to delve into the trading details of traders.

Fortunately, in recent years, some high-quality platforms have begun to make changes, such as EBC Group.

Relying on the data exchange capability of EBC, the EBC tracking platform can achieve millisecond level tracking, maximizing the reproduction of trader operations. At the same time, the EBC tracking community can follow orders with one click and copy champion profits for free.

In addition, EBC provides a six dimensional evaluation chart for each trader to help understand their order making style. More importantly, investors can view each order in real-time, copy the transaction, and learn the order making skills of traders.

Of course, the most important thing is that EBC has also launched the "Payroll Plan" simultaneously.

As long as traders send signals in the community to meet certain requirements for managing funds and following customer volume, they can receive salaries of varying amounts per month. Especially in the stage of 'legendary trader', in addition to a basic salary of $10000 per month, they can also receive an additional 1% of management funds.

In my opinion, through the 'paid plan', the final income of traders depends on their actual trading level, allowing them to focus on trading without distractions and providing investors with better signals.

A win-win situation for both traders and investors is necessary to build a good tracking ecosystem, which will inevitably lead to the development of successful traders and lead the entire forex market.

4、 At present, mature overseas platforms are still the first choice for participation

At present, although there are a group of mature traders in China, investment channels are still relatively limited, and the best way to participate is through mature overseas trading platforms.

A very flexible and mature model for forex regulation has long been established overseas, with the UK's bimodal regulatory model being a model for financial regulation in various countries, making the UK FCA the preferred choice for global foreign exchange investors.

In addition to strict fund custody requirements, FCA will regularly conduct qualification reviews and layer by layer background checks on licensed institutions to ensure the safety of users' funds.

Recently, UBS's complete write down of AT1 bonds led to significant losses for related investors, which also exposed the importance of investor protection in the current investment environment. This further highlights the regulatory value of the FCA, which is the only investor protection program in the industry.

Therefore, the most suitable way for domestic investors to participate in margin trading is still through licensed institutions under the FCA. How can we identify and differentiate between legitimate FCA licensed institutions?

Generally, FCA will update the regulatory status of the trading platform in real-time on its official website, specifying the effective date of regulation; And legitimate platforms will also provide FCA regulatory numbers for investors to check.

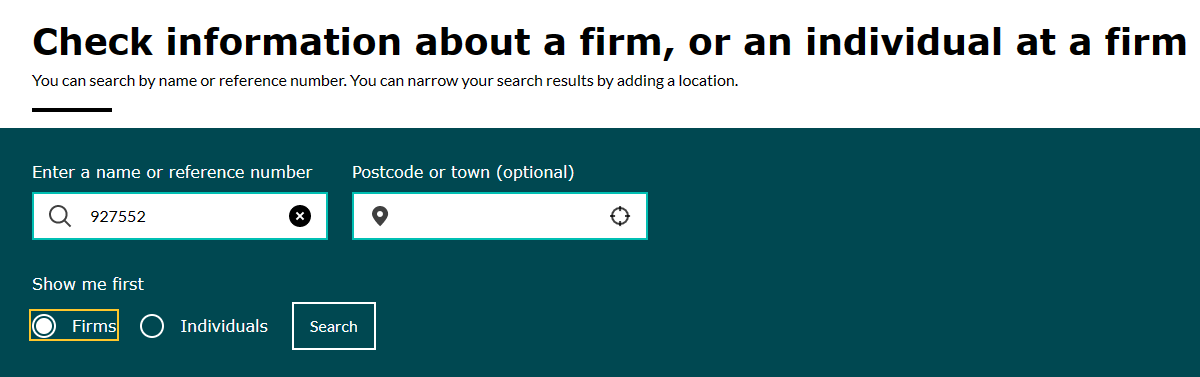

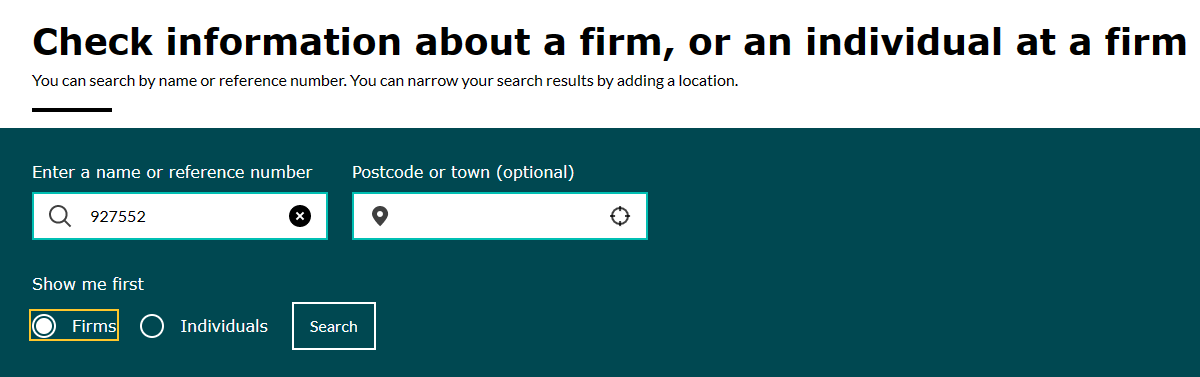

Taking the FCA licensed institution EBC as an example, open the FCA inquiry website: https://register.fca.org.uk/ Enter the regulatory number 927552 of EBC in the search bar and click on firms to search.

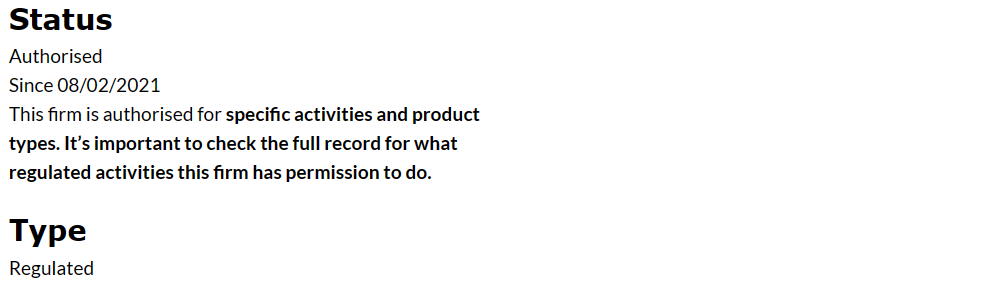

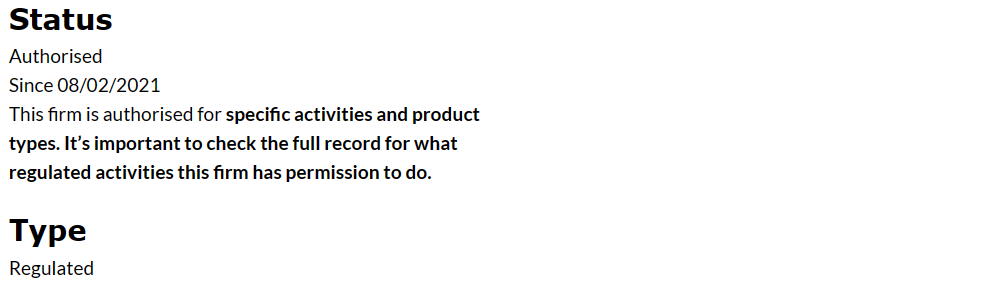

Then we can see all the detailed information about EBC, with Authorized and Regulated displayed in the Status and Type columns respectively, indicating that the company is under effective supervision by the FCA.

Please note that the Status column must only have the words' Authorized '. If it is an EEA Authorized (European Union license plate) or other words, it is not fully licensed supervision.

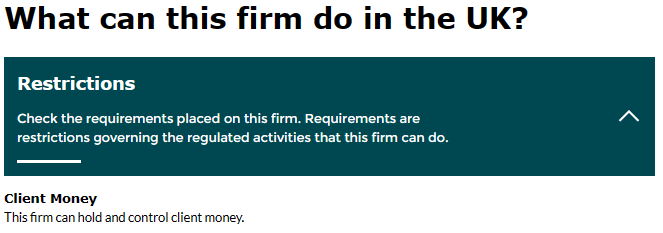

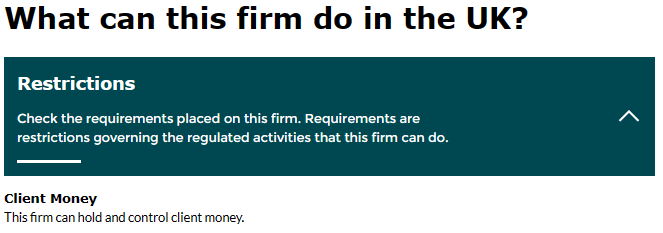

Step 2, check the Client Money column

For example, in this column, EBC displays "This firm can hold and control clientMoney. Only the fully regulated license plate will display such words.

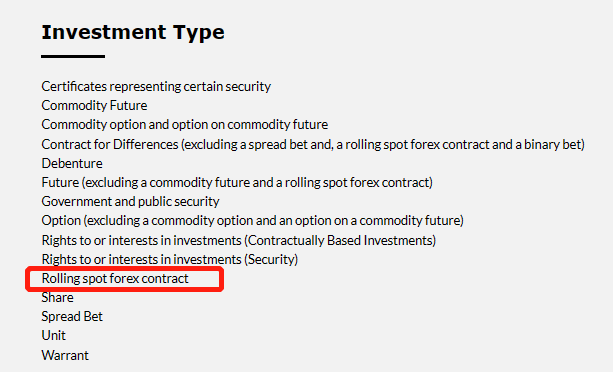

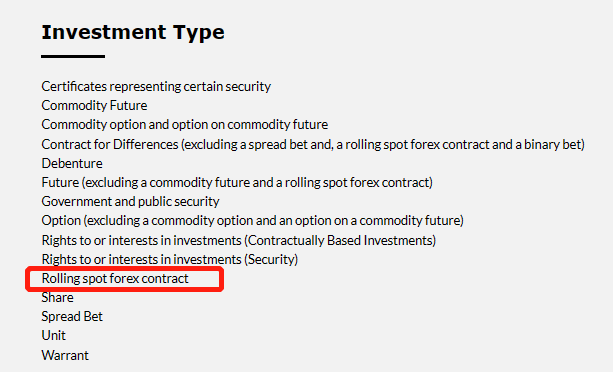

Step 3, check the Investment Type. If the platform information does not involve spot forex trading (Rolling spot forex)Contract), then we need to quickly keep an eye on it.

After completing the above three stEPS, it is basically possible to determine whether a platform is a licensed institution under full FCA supervision.

Overall, due to the stage of financial development, the domestic forex market is still in the exploratory stage. But as Huang Zemin, the director of the Institute of International Finance at East China Normal University, said before, the most important criterion for measuring the Shanghai International Financial Center is foreign exchange, and it is recommended to list this variety of forex margin trading.

As the most active trading market in the world, the "sunshine" of the forex market will be the only way for the development of the capital market.