Indian equities are poised for a flat open today after enjoying five straight sessions of gains. As optimism around landmark GST reforms runs high, traders are watching keenly to see how these changes could impact stocks across major sectors in the coming months. The reforms are joined by hopes for progress in Russia-Ukraine peace talks and improving India-China relations, all contributing to today's steady GIFT Nifty futures.

Why Are GST Reforms Dominating Indian Market News?

The Goods and Services Tax (GST) has been at the centre of recent market optimism, following the government's announcement of major amendments aimed at making tax compliance simpler and improving business liquidity. The GST Council's latest proposals include uniform tax rates for select manufacturing and supply chains, removal of several procedural bottlenecks, and electronic invoice requirements for SMEs.

For investors, these reforms have sparked hopes for:

-

Lower compliance costs

-

Reduced tax-related litigation

-

Improved revenue transparency

Faster input tax credit claims

How Are Indian Markets Responding Today?

On August 21, 2025, the Nifty 50 and BSE Sensex are projected to open flat, holding near recent highs after rallying in response to the reforms and upbeat policy signals. The GIFT Nifty futures were steady at 24,540, reflecting positive sentiment but caution over profit booking after last week's run-up.

Major indices:

| Index |

20 Aug Close |

Projected Open |

Weekly Change |

| Nifty 50 |

24,535 |

24,540 |

+2.1% |

| BSE Sensex |

81,423 |

81,430 |

+2.0% |

| GIFT Nifty |

24,540 |

24,550 |

+2.3% |

Sector rotation is expected, with banks, FMCG, and infra stocks benefiting most from the proposed GST changes.

What Do GST Reforms Mean for Indian Stocks?

The GST Council's measures provide a tailwind to several key sectors, with analysts eyeing the following top beneficiaries:

Banks & NBFCs:

Improved tax clarity and a simplified compliance regime should reduce operational costs, particularly for finance and lending institutions.

FMCG (Fast-Moving Consumer Goods):

Uniform GST rates remove ambiguities in supply chain pricing and resolve disputes over classification, positively affecting consumer companies.

Infrastructure & Construction:

Simplified e-invoicing requirements could streamline contractor payments and improve working capital flows for infrastructure projects.

Automobiles:

Unified rates and quicker input tax credit processing lower manufacturing costs, potentially enabling price cuts or margin improvements.

Technology & E-commerce:

Digital tax management helps online retailers and platforms operate more efficiently and widen their compliance coverage.

Key Features of the Latest GST Council Amendments

-

Uniform GST rate of 18% for selected manufacturing inputs.

-

E-invoicing made mandatory for businesses above ₹50 million turnover, aiding traceability.

-

Removal of the “reverse charge” mechanism in many B2B transactions, reducing paperwork.

-

Fast-track clearance for input tax credits, targeting 7-day settlements.

Rationalisation of tax slabs for consumer durables and small appliances.

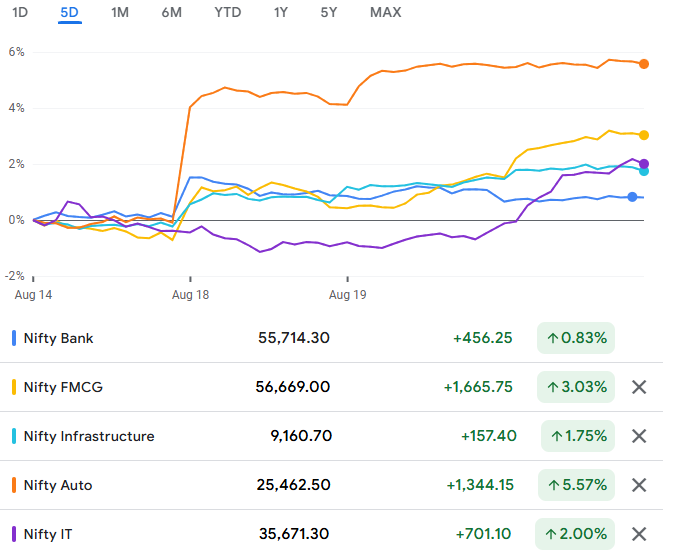

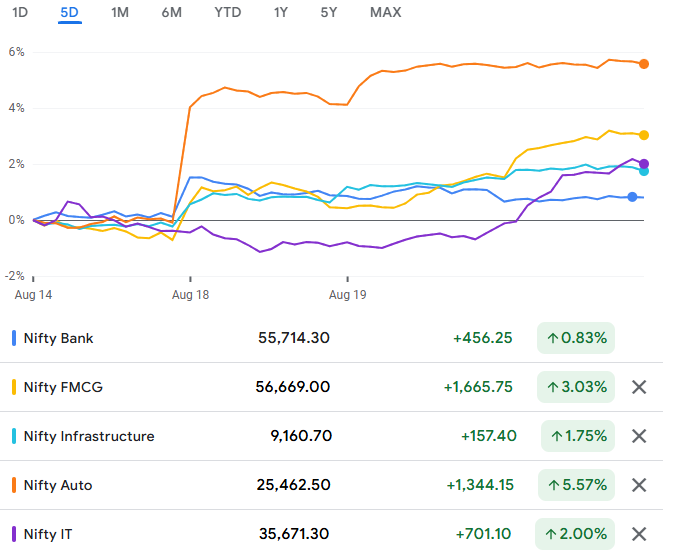

Recent Performance: Markets React to GST Optimism

Indian equities rallied by over 2% this week, with sector indices strengthening:

What Other Factors Are Affecting Sentiment?

While GST dominates the headlines, traders are also focused on:

-

Russia-Ukraine peace process: Efforts towards conflict de-escalation have lifted global risk appetite.

-

India-China relations: Reports of improved diplomatic engagement are reducing cross-border investment risks.

Global cues: Major world indices were mixed overnight, with tech-led losses in the US offset by steady Asian performance.

Conclusion

Indian equities are consolidating gains near record highs, but the GST reforms offer a fresh catalyst that could keep momentum alive across leading sectors. Investors should watch for further Council updates and real-time sector rotation as GST changes roll out.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.