The United States Natural Gas Fund (UNG) remains one of the most popular vehicles for traders looking to capitalise on short-term moves in natural gas prices. With its direct exposure to front-month Henry Hub futures, UNG offers fast, liquid access to one of the most volatile commodities in the energy space. But beneath the surface lies a complex structure shaped by contango, monthly roll mechanics, and a tendency to diverge from spot prices.

For short-term traders, understanding how UNG behaves—especially during seasonal demand shifts, weather events, and macro supply shocks—is key to turning volatility into profit.

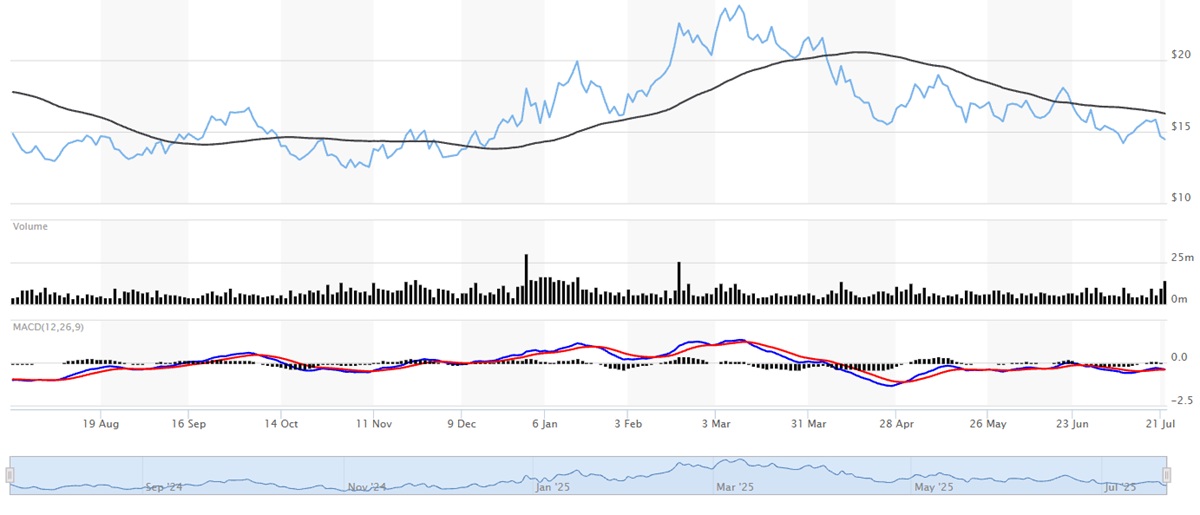

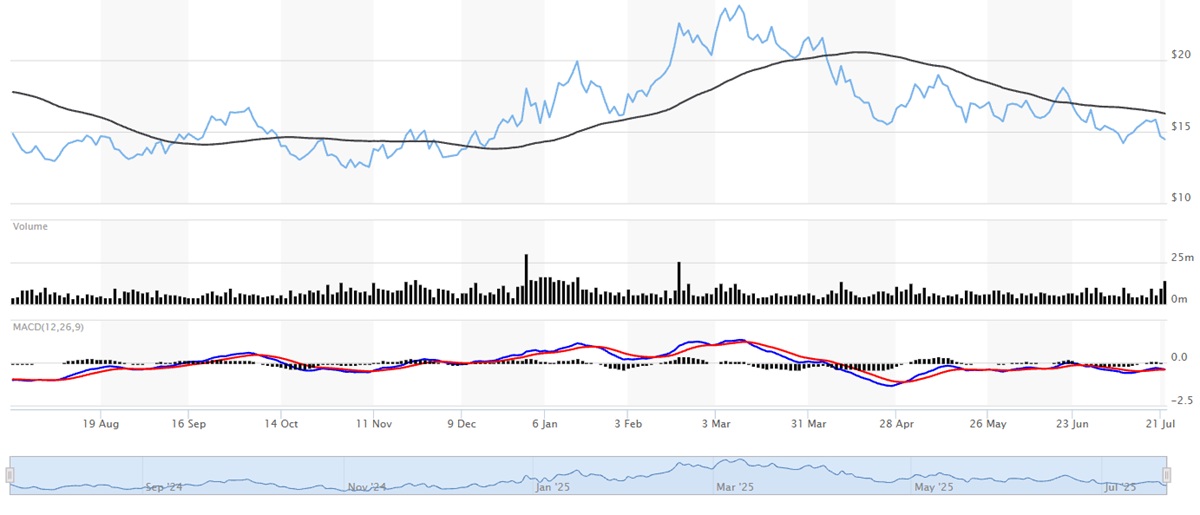

Price‑Action Snapshot (as of 23 July 2025)

YTD Performance: –13.9 %, sharply underperforming the front-month gas contract, which has shown signs of a summer rebound.

52-Week Range: $12.35 – $24.33. With the current price sitting at $14.47. UNG trades in the lower third of its yearly band.

Liquidity: The 30-day average daily volume is approximately 6.9 million shares, while intraday volume topped 14 million on 23 July. This ensures tight spreads and ample depth for both swing and intraday scalping strategies.

Volatility: The 14-day Average True Range is $0.65 (~4.5% of current price), reflecting significant intraday range. Implied volatility sits around 54%, modestly above 20-day realised vol.

Trend Bias: UNG is 14% below its 200-day SMA ($16.91), keeping momentum skewed to the downside, though sharp mean-reversion setups remain viable.

What's Driving Price Behaviour?

| Driver |

Trading Take |

| Weather Volatility |

Peak cooling season weather is inflating short-term demand expectations, but gas repeatedly fades above $3.30–3.40/mmbtu. Traders fade breakouts unless EIA surprises with strong draws. |

| AI & Power Demand |

Data centres and AI-related electricity demand continue to lift mid- to long-term gas consumption forecasts. Dips near breakeven production costs (~$2.75) are attracting institutional interest. |

| Rig Activity & Production Discipline |

Rig counts have declined, tightening supply into Q4. Winter strip futures reflect an expected 10% year-over-year storage deficit. Curve steepening suggests long-term accumulation is building. |

| Global LNG Dynamics |

Reduced wind power output in Europe and geopolitical flows are increasing global reliance on U.S. LNG. This acts as a macro tailwind and can inject overnight gap risk into UNG. |

Active traders should pair technical setups with weekly EIA storage prints and NOAA weather forecasts to time directional moves.

Futures Curve & Roll Mechanics

Despite not being leveraged, UNG suffers from structural decay due to monthly futures roll exposure. The ETF primarily holds near-month NYMEX natural gas contracts and rolls them forward prior to expiration.

Current Curve:

Aug '25 futures: $3.255

Sep '25 futures: $3.282

Contango: +0.8%

If this spread remains consistent, roll drag would reduce returns by ~9–10% annually—a significant cost for long-term holders but a manageable bleed for tactical traders.

Takeaway for traders: Use UNG for short- to medium-term setups only. Long-dated holding periods allow contango to erode profits over time.

Trading Alternatives to UNG

| Ticker |

Structure |

Best Use Case |

Watch-Outs |

| UNL |

12-month futures ladder |

Reduce roll decay; better for multi-week swing trades |

Lower volume and slower reaction time |

| BOIL |

2× Daily Long Natural Gas |

Intraday volatility trades with leverage |

Not suitable for multi-day holds; compounding risk |

| KOLD |

2×Daily Short Natural Gas |

Hedging or shorting quick gas spikes |

Subject to same decay as BOIL |

| FCG |

Natural gas equity ETF |

Gain exposure to gas through producers |

Equity beta dilutes correlation to commodity price |

UNG is still the best vehicle for most directional, short-term natural gas trades, provided traders respect its limitations.

Tactical Outlook: Q3–Q4 2025 Trading Themes

Late-Summer Fade

Seasonally, August tends to soften following July demand peaks.

Setup: Fade UNG spikes above $15.30 using tight stops; target $13.60–13.80 into mid-August.

Hurricane Event Plays

Winter Curve Steepener

AI Demand Narrative Trades

As AI-driven electricity demand dominates headlines, look for producer outperformance.

Setup: Long FCG vs short KOLD on soft gas pullbacks.

Weekly EIA Print Reactions

Risk Management Tip: Use ATR-based stop sizing. With UNG's ATR at $0.65. a 1.5× ATR stop (≈$0.98) fits most day and swing trade setups.

Final Thoughts

UNG remains a popular vehicle for trading natural gas, but it's critical to understand how it functions—particularly the impact of contango, roll decay, and its detachment from spot prices during volatile periods. For informed, short-term traders, it offers clean access to momentum and reversion opportunities within the natural gas space.

However, it is not built for passive investors. Use it actively, trade it tactically, and always anchor your setups with both technical structure and macro awareness.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.