Selecting a broker with the lowest spread is a key consideration for traders aiming to reduce their trading costs and improve their overall profitability. The spread—the difference between the buying and selling price of a currency pair—can significantly impact your trading success, especially for those who trade frequently or in small margins. However, the choice of broker based on spread isn't as simple as picking the one with the lowest figure. Several factors play into this decision, and it's important to understand how they all come together to determine the best option for you.

Fixed vs. Variable Spreads: Which is Better for You?

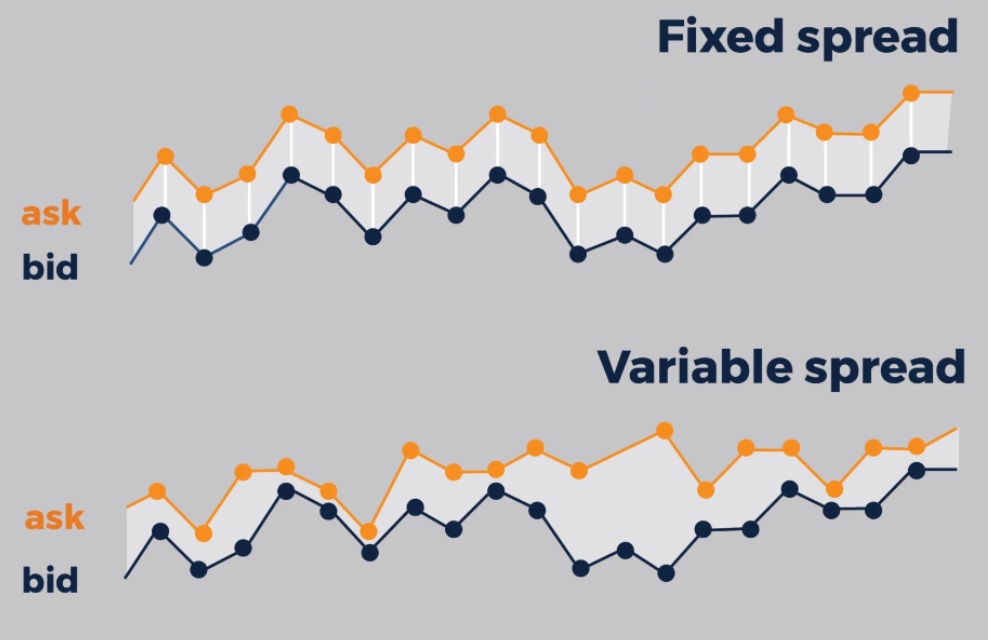

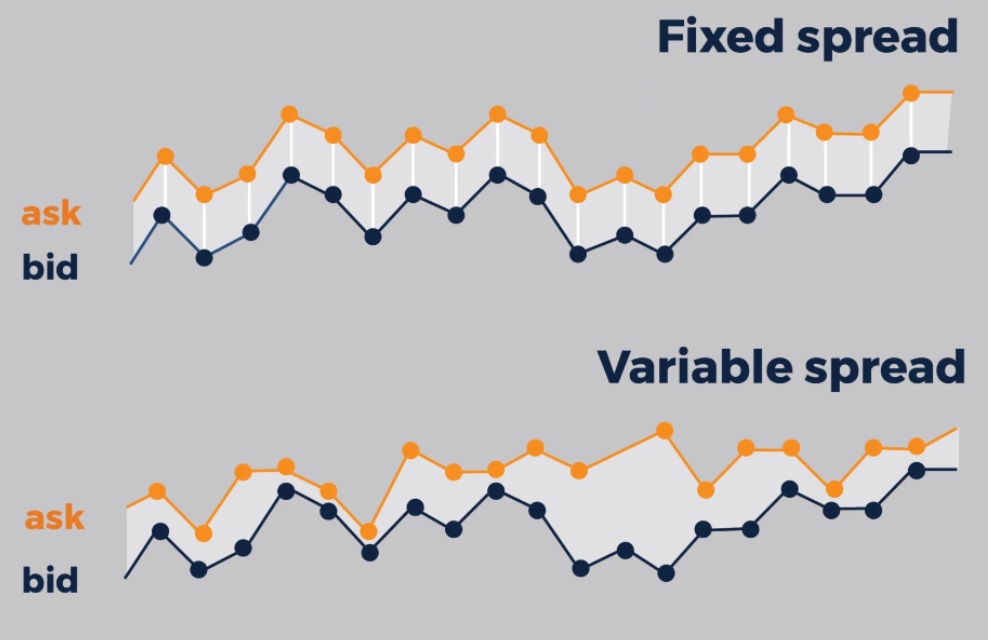

Forex brokers typically offer two types of spreads: fixed and variable. A fixed spread stays the same regardless of market conditions, meaning you know exactly what you're paying when you enter or exit a trade. This can be helpful for traders who prefer consistency, as they can plan their trading strategy without worrying about changes in spread size.

On the other hand, variable spreads fluctuate depending on market volatility. These spreads can widen during times of high volatility, such as during economic announcements or major news events. While they can be very tight during calm market conditions, they are subject to change. For traders who focus on scalping or short-term trading, variable spreads can be both an advantage and a disadvantage, depending on the timing of trades and market conditions.

When deciding between fixed and variable spreads, it's essential to consider your trading style. If you prefer a predictable and stable trading environment, a fixed spread may be more suitable. However, if you're comfortable with the risks of fluctuating spreads and aim to take advantage of low spreads during quiet market periods, variable spreads might be the better choice for you.

Account Types: Do They Affect Your Spreads?

When selecting a forex broker, it's important to understand that the type of account you choose can have a significant impact on the spreads you receive. Brokers usually offer multiple types of accounts, such as standard accounts, ECN (Electronic Communication Network) accounts, and commission-based accounts. Each of these accounts comes with different spread structures.

For example, standard accounts typically offer wider spreads since brokers make their money by marking up the spread. These accounts are usually suitable for beginners or traders who don't trade frequently. ECN accounts, on the other hand, provide access to direct market liquidity and offer much tighter spreads. The catch is that brokers usually charge a commission per trade. If you're an experienced trader who makes many trades, an ECN account could be more beneficial as it provides lower spreads, despite the commission.

Some brokers also offer commission-free accounts with wider spreads, which can be appealing for traders who want to avoid additional charges. However, these accounts may end up being more expensive in the long run if you trade frequently, as the broker compensates for the absence of commission with a wider spread. It's essential to compare the total cost of trading, including spreads and commissions, to ensure you're getting the best deal for your trading style.

What is a Zero Spread Forex Broker?

A zero spread forex broker is one that offers trading with no difference between the bid and ask price. This means the spread is technically zero, which sounds appealing, especially for traders looking to minimise their costs. However, it's important to note that these brokers often make up for the lack of spreads by charging commissions per trade. In this case, the broker profits from commissions rather than from a markup on the spread.

The appeal of zero spread forex brokers lies in the transparency of pricing. Without spreads, traders know exactly what they are paying in commission, and there is no hidden cost in the spread. Zero spread accounts can be particularly attractive for high-frequency traders or scalpers, as they avoid the constant fluctuation of spreads, especially during volatile market conditions. However, the commission rates for these accounts may vary, so it's essential to calculate how much you’ll pay in commission and ensure it's still competitive compared to other brokers.

It's worth noting that not all currency pairs will be offered with zero spreads, and some brokers may only offer zero spreads on major pairs during specific hours when liquidity is high. For other pairs or during times of low liquidity, brokers may impose wider spreads.

Can I Trust These Lowest Spread Forex Brokers?

While it's tempting to choose a forex broker based solely on the promise of low spreads, trust and reliability should always be at the forefront of your decision. A broker offering low spreads but lacking proper regulation or a good reputation could lead to problems down the line. It's essential to ensure that any broker you choose is regulated by a reputable financial authority, such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia. This ensures that the broker adheres to strict standards of financial conduct, offering transparency and security for your funds.

Additionally, the broker should have a reliable trading platform, excellent customer service, and positive reviews from other traders. A broker with consistently low spreads but poor execution or high fees in other areas may not be the best option, even if their spreads seem attractive at first glance. Before committing to any broker, make sure to read reviews, check for any complaints, and ensure that the broker offers a trustworthy service, as this will help protect your funds and provide peace of mind when trading.

In summary, when choosing a forex broker based on the spread, it's crucial to understand the type of spread they offer (fixed or variable), how different account types affect spreads, and whether a zero spread broker could be the right fit for your trading needs. While low spreads can certainly reduce your trading costs, ensure you balance this factor with other essential elements like regulation, execution speed, and reliability to make the best choice for your trading strategy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.