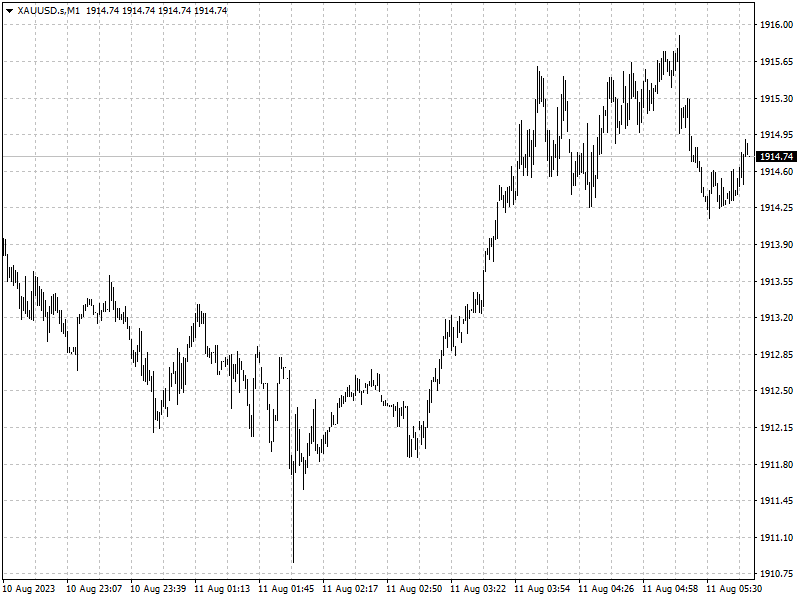

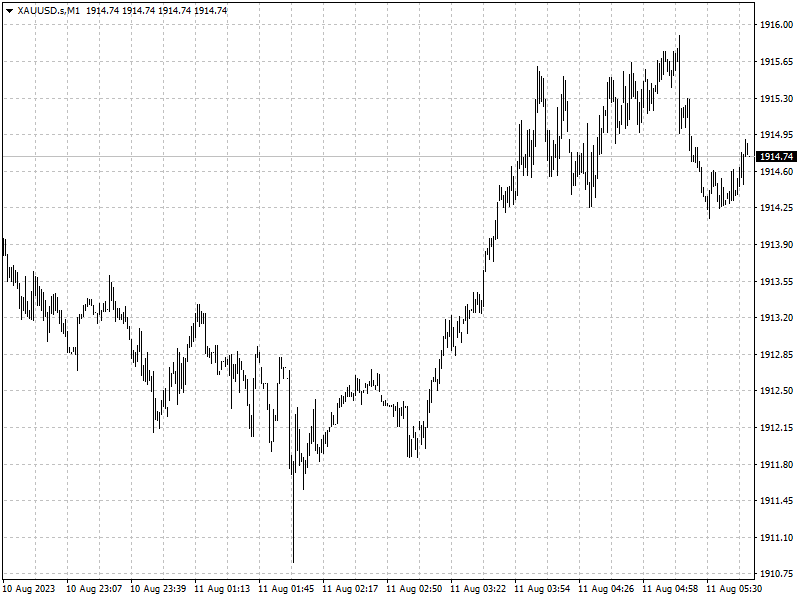

Gold prices are on track to rally to all-time highs in 2024 on the back of

tapering interest rates. U.S. core CPI increased 0.2% for the second straight

month, the first time since February 2021.

Other recent economic data has shown signs of a cooling labour market. Recent

data showed the U.S. economy added 187,000 jobs in July, the fewest since

December 2020.

Spot gold prices hit its intra-day record of 2,072.5 in 2020 and some

analysts believe the precious metal will hit a new high beyond that level.

Gold will rise above 2,100 in late 2023 or early 2024 as the Fed has almost

won its inflation fight, said Bart Melek, TD Securities’ managing director and

global head of commodity strategy.

UOB also forecasts that gold prices will set new records, but only by the

second half of 2024, predicting that gold will trade at $2,100 per ounce

then.

Markets are currently pricing in a 90% chance that Fed maintains its

benchmark interest rate in a range of 5.25%-5.50% in September, the CME FedWatch

Tool showed.

Chinese retail gold demand has been resilient in 2023 even as consumption of

other commodities remained weak, Citi said in a July report.

Citi projects more than 700 ton of jewelry demand, up 22% from the same

period last year, from China this year. central bank purchases of gold have also

been strong, especially from brics countries.

Disclaimer: Investment involves risk. The content of this article is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.