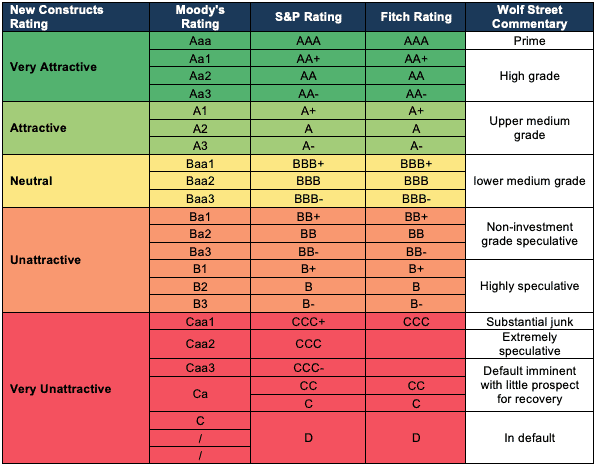

A Fitch Ratings analyst warned that the U.S. banking industry will likely

face the risk of sweeping rating downgrades.

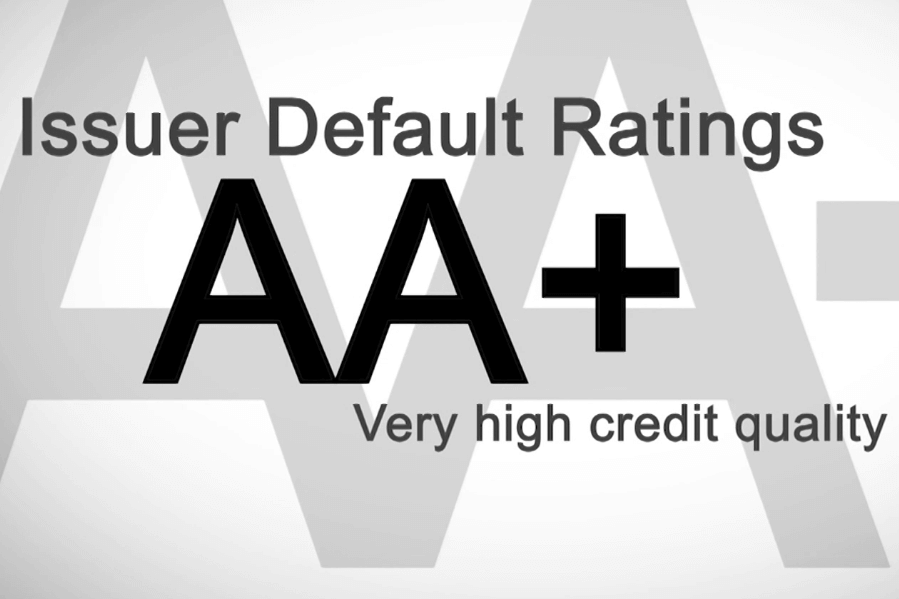

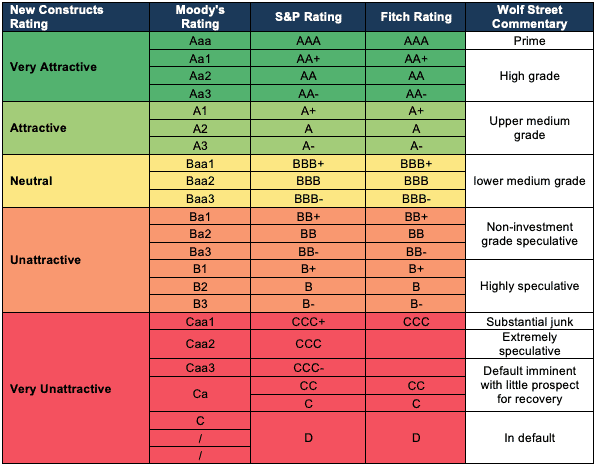

If one-notch downgrade from AA- to A+ is implemented, more than 70 banks

would be affected including some industrial behemoths. JP Morgan and BOA could

be among them.

This sort of act has created a ripple effect lately. Moody’s downgraded

several small- to middle-sized banks last week and Fitch did that to the US

long-term credit rating based on bloated structural fiscal deficit earlier this

month.

Fitch already cut the industry’s assessment in June amid fast-increasing

interest rates, so the decision of another cut somewhat catch investors by

surprise given signs that the Fed will end its aggressive tightening cycle very

soon.

Some lenders at the lower bounds of investment grade would take a heavy blow

particularly after inching one step closer to non-investment grade.

The impact of a broad downgrades as such remains hard to predict beyond

losses of bank bonds and stocks which are expected to squeeze profit margins

further.

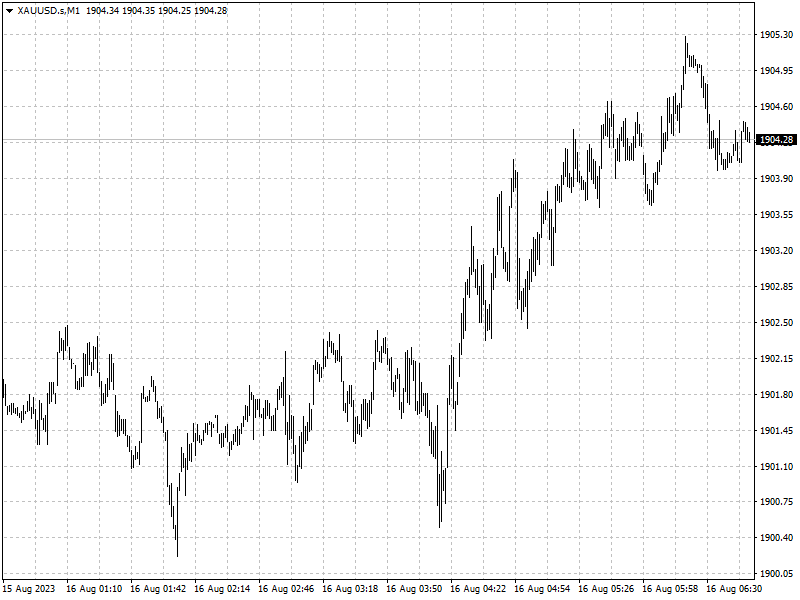

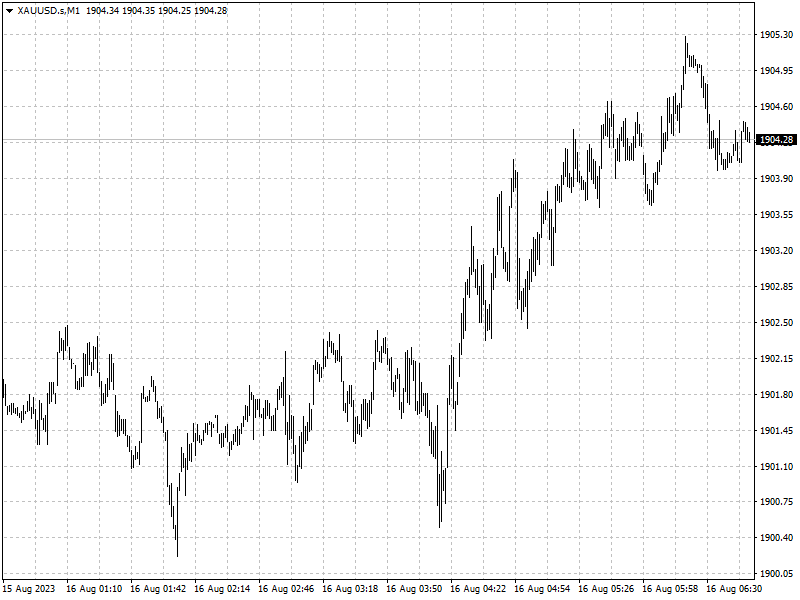

Traditionally, gold prices tend to rise in response to a financial shock in

the US. However, a push higher proved to be fleeting following Fitch downgrade

of the US credit rating.

A potential selloff in Dow and the S&P 500 might be used as an

opportunity to increase long position as economic data that continues to come in

stronger point to manageable systemic risks.

Disclaimer: Investment involves risk. The content of this article is not an

investment advice and does not constitute any offer or solicitation to offer or

recommendation of any investment product.