The Euro to US Dollar (EUR/USD) exchange rate is a critical focus for forex traders, reflecting the economic dynamics between two of the world's largest economies.

As we look ahead to the next six months in 2025, this article provides a detailed forecast, highlighting key factors, technical analysis, and actionable insights for traders aiming to capitalise on potential movements in this major currency pair.

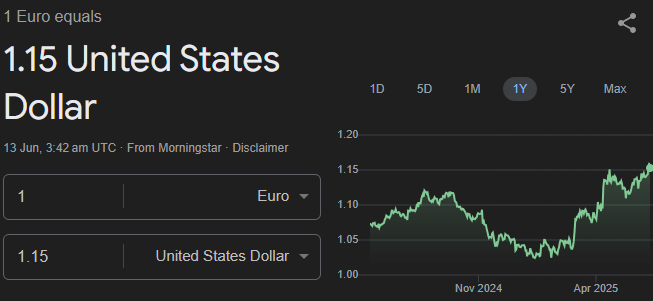

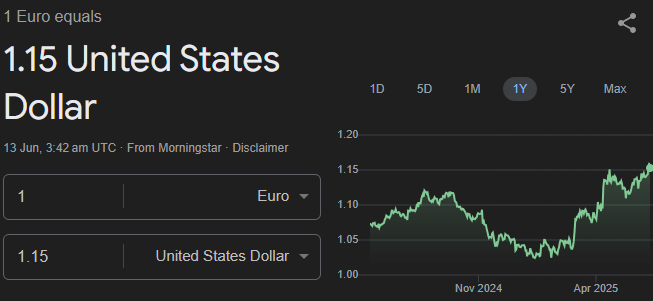

Current Euro to Dollar Exchange Rate

As of mid-June 2025, the EUR/USD pair is trading around 1.1544, having recently extended gains to multi-year highs near 1.1630, a level not seen since October 2021. This upward momentum follows a 12.7% rise from a low of 1.0243 on 12 January 2025, driven by renewed US-China trade dialogue and diverging central bank policies.

However, short-term and medium-term sentiment remains bearish according to some analysts, while long-term views are more bullish.

Euro to Dollar Forecast: Next 6 Months

Short-Term Projections (June to September 2025)

Forecasts for the immediate months suggest mixed movements for EUR/USD. Analysts predict the pair could fall to around 1.1268 by the end of June 2025, a 2.39% decline from current levels, before potentially rising to approximately 1.1403 by September 2025 (Q3).

Some projections are slightly more pessimistic, estimating the rate at 1.11 by the end of the current quarter. Technical analysis indicates a potential near-term correction to 1.1333 before a possible rise to 1.1515.

Medium-Term Projections (October to December 2025)

Looking further ahead, forecasts suggest the EUR/USD rate may reach around 1.1527 by December 2025 (Q4), reflecting a gradual upward trend. More optimistic outlooks project the pair to trade between 1.1400 and 1.1800 from July to September, with an average potentially above 1.33 by year-end in some bullish scenarios.

However, caution remains, with some analysts noting that breakout potential above 1.10 may be limited, and a range of 1.05–1.07 is possible if downward pressure intensifies.

Key Drivers Influencing EUR/USD

1. Central Bank Policies

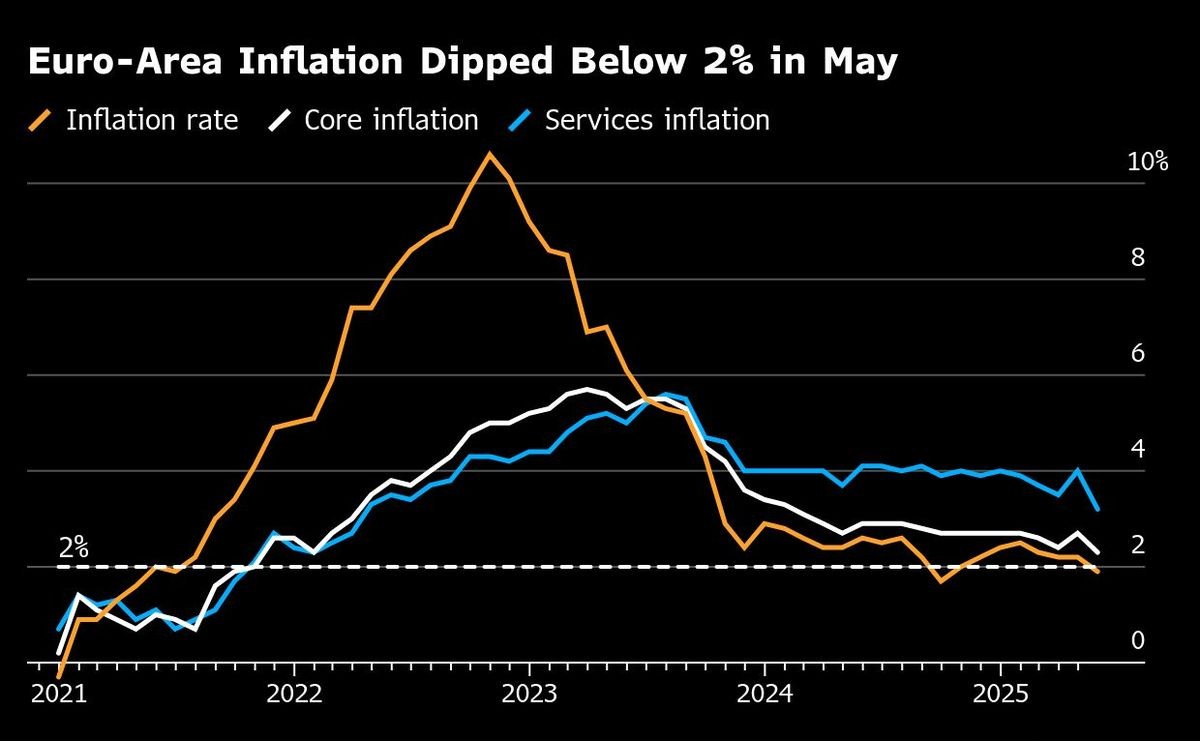

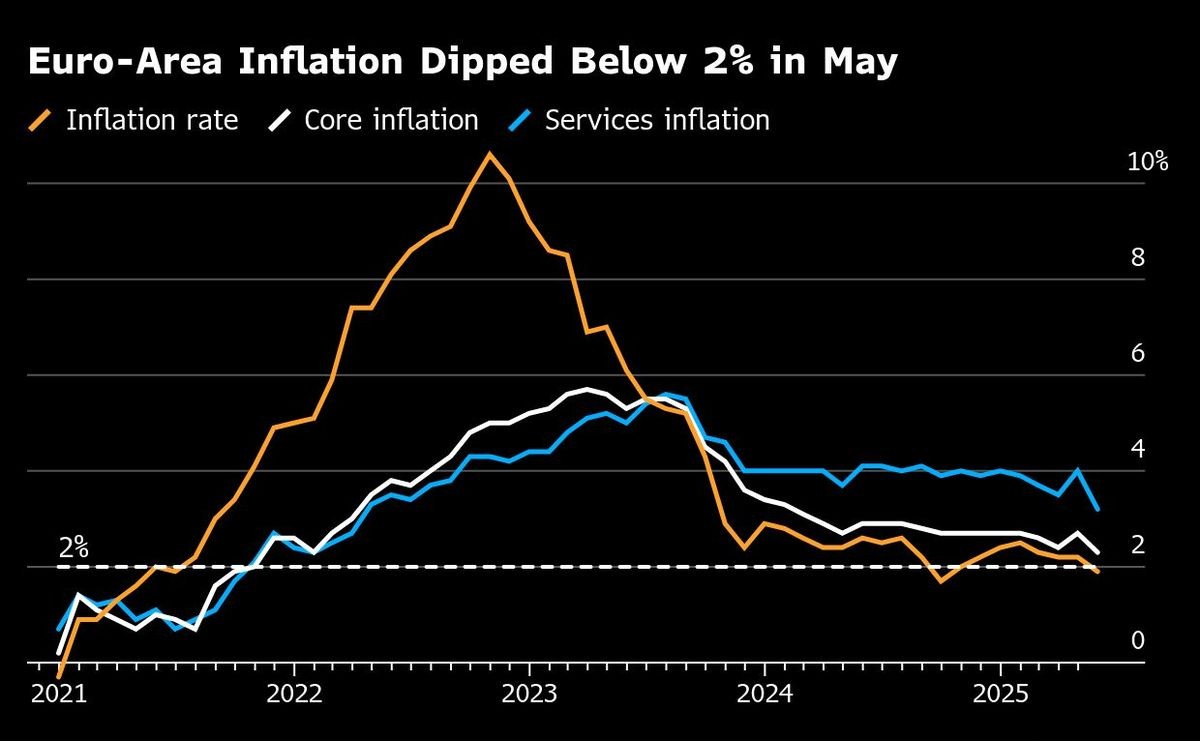

Diverging monetary policies between the European Central Bank (ECB) and the US Federal Reserve (Fed) are a primary driver. The ECB has signalled a more hawkish stance, with President Christine Lagarde indicating that further rate cuts will be harder to justify, suggesting the bank is nearing the end of its easing cycle.

In contrast, the Fed is expected to adopt a more dovish tone, potentially cutting rates if US unemployment rises above 4.1–4.2%, which could weaken the dollar . This policy divergence supports potential EUR/USD gains in the near term.

2. Economic Indicators

Eurozone growth has been revised upward, with Q1 2025 GDP at 0.6% quarter-over-quarter, the fastest since Q2 2022, bolstering the euro . Meanwhile, US economic data, such as retail sales and inflation figures, will be critical. Strong US data could provide short-term dollar support, while weaker figures may reinforce Fed dovishness.

3. Geopolitical and Trade Developments

Recent US-China trade détente, including a potential truce and tariff agreements, has lifted global risk appetite, supporting the euro . However, upcoming US elections under a returning Trump administration and political turmoil in Germany and France could introduce uncertainty, potentially strengthening the dollar as a safe haven.

4. Market Sentiment and Risk Appetite

Market sentiment plays a significant role in EUR/USD movements. Speculative trading and risk appetite can drive volatility, especially around major data releases or geopolitical events . If global risk sentiment deteriorates, the dollar may gain as a defensive asset.

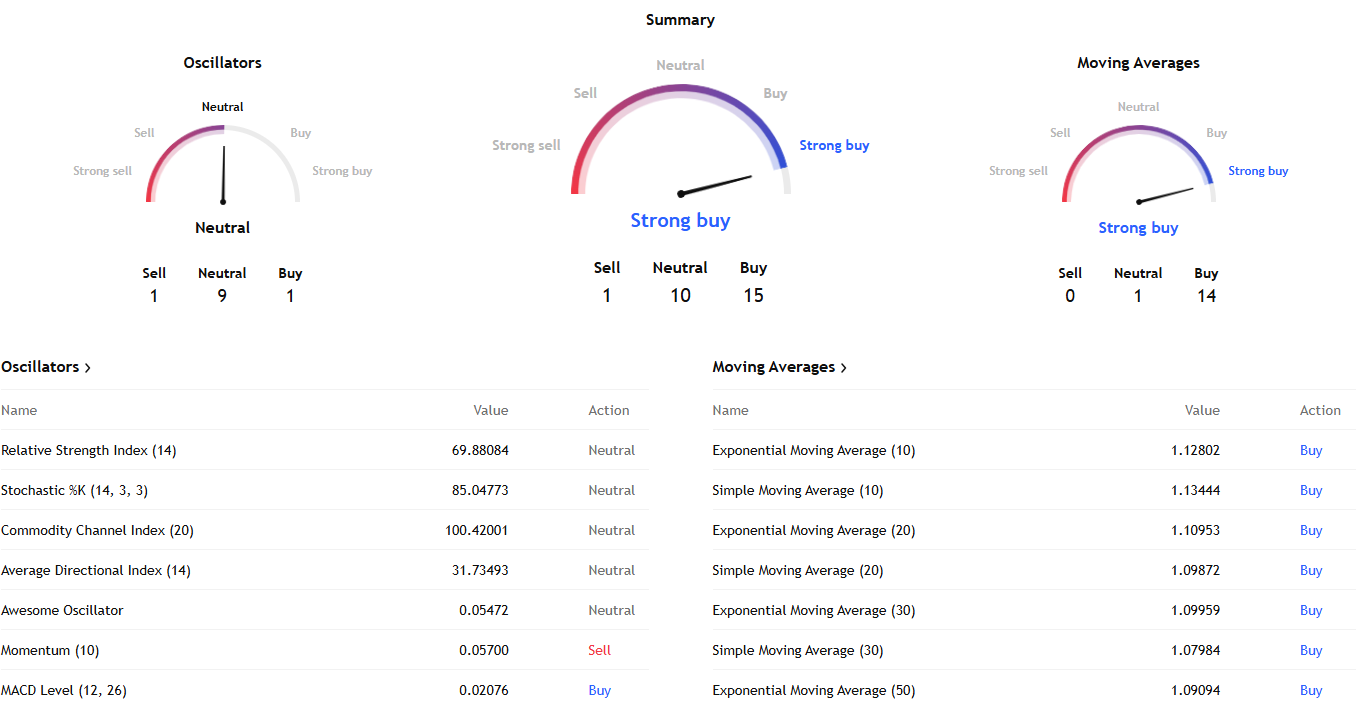

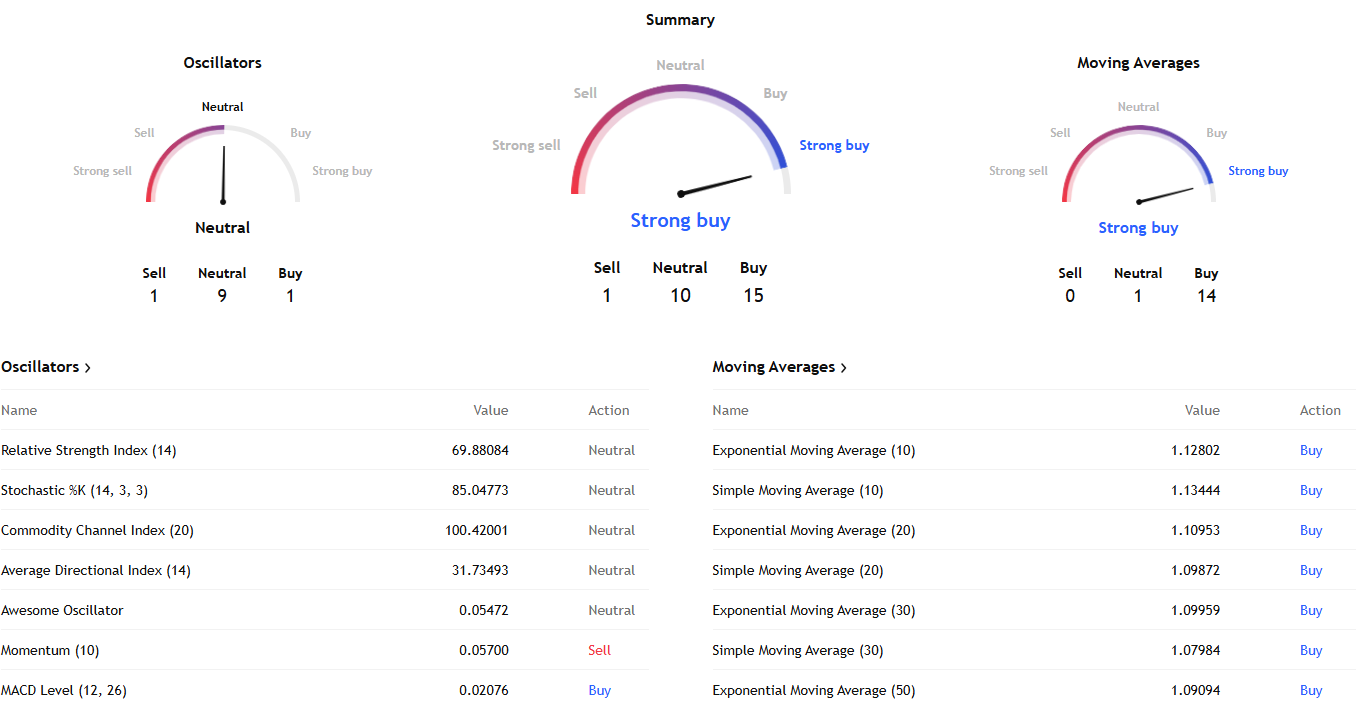

Technical Analysis for Traders

Technical indicators suggest a complex outlook for EUR/USD over the next six months. The pair recently breached resistance at 1.1550, reinforcing short-term bullish momentum, with stability above the 50-day EMA providing dynamic support.

However, overbought conditions on the RSI warn of potential correctional waves if the pair fails to hold above 1.1550. Key levels to watch include:

Support: 1.1333 (near-term correction target), 1.1200–1.1250 (Fibonacci retracement and trendline support), and 1.1100 (intermediate support).

Resistance: 1.1650 (initial target), with further upside potential to 1.1766–1.1800 if bullish momentum persists.

A sustained break below 1.1200 could signal a deeper bearish move toward 1.1000 or 1.0900, while holding above 1.1550 supports further gains.

Trading Strategies for the Next 6 Months

1. Trend Following

Given the short-term bullish trend, traders can look to buy on pullbacks to support levels like 1.1333 or 1.1250, targeting resistance at 1.1650 or higher. Use moving averages to confirm trend direction.

2. Range Trading

If EUR/USD consolidates between 1.1333 and 1.1650, range traders can buy near support and sell near resistance, capitalising on sideways movement.

3. Breakout Trading

Watch for a decisive break above 1.1650 to enter long positions, or below 1.1200 for short opportunities, with stop-losses to manage risk.

4. Event-Driven Trading

Monitor key events like Eurozone CPI, US retail sales, and central bank announcements for volatility spikes. Position ahead of or react to these catalysts with tight risk controls.

Risk Management Tips

Stop-Loss Orders: Set stops below key support levels (e.g., 1.1200 for longs) to limit downside.

Position Sizing: Avoid over-leveraging, as policy shifts or unexpected data can trigger sharp moves.

Stay Informed: Follow economic calendars for ECB/Fed decisions, GDP, and inflation data releases.

Conclusion

The Euro to Dollar forecast for the next six months presents a mixed but opportunity-rich outlook for traders. With projections ranging from 1.1268 to 1.1800 by December 2025, and key drivers like central bank divergence, economic data, and geopolitical events shaping the pair, staying agile is crucial.

By leveraging technical levels and adopting tailored strategies, traders can navigate the EUR/USD landscape with greater confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.