EBC Group has always regarded the safety of funds as the first principle. In

order to build a more complete, multi-level and all-round security system, EBC

has recently joined The Financial Commission's Protection Fund, which provides

up to 20,000 euros of additional compensation for each partner.

The Financial Commission, the world's first international leading

organization to provide dispute resolution for the financial industry, ensures

that disputes in transactions are resolved quickly and fairly through a strict,

transparent and open hearing mechanism.

Follow the link https://financialcommission.org/ebc-financial-group/ or scan the OR code

A maximum of 20,000 euros per customer for additional payment protection

With more and more authoritative regulatory bodies to EDR (External Dispute

Resolution) mechanism into the supervision, EBC actively practicing compliance

management, explore new, cutting-edge service model, improve service

quality.

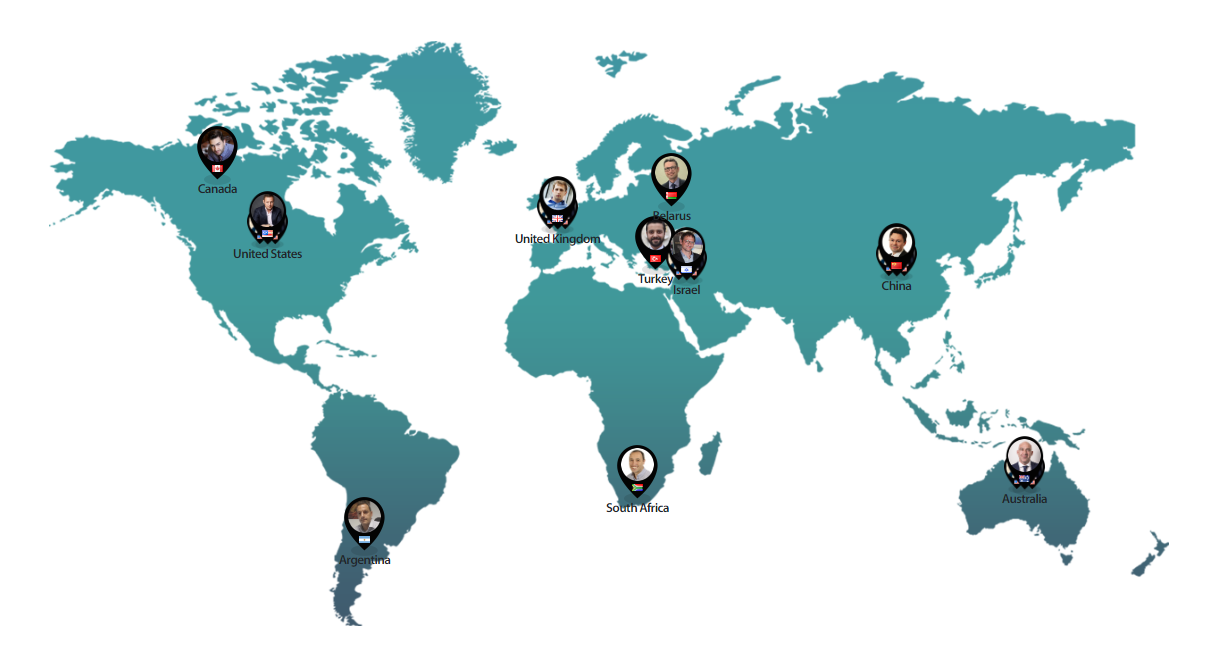

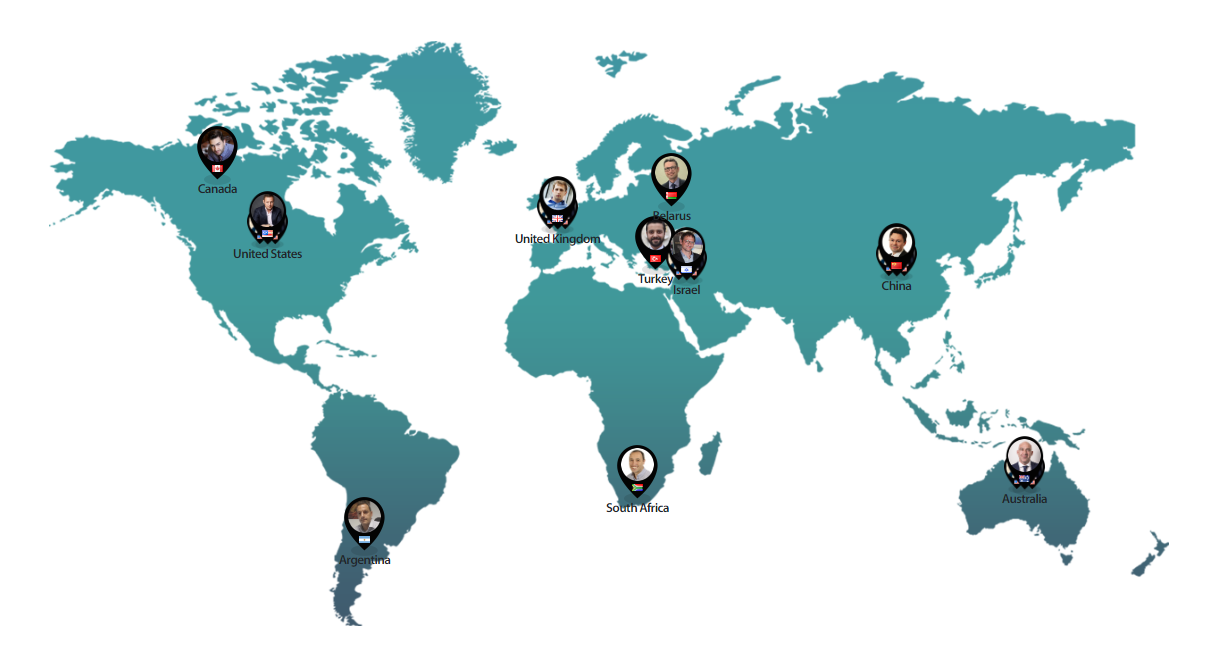

The Financial Commission has a professional risk control and execution team

consisting of 35 senior industry experts around the world, capable of accurately

identifying risky factors, and working in depth with more than 20 international

experts and lawyers to form fast and flexible solutions in the trading process

and at the regulatory level.

This means that if the user's loss is caused by objective factors such as

trading brokerage system errors, quote delays, etc., The Financial Commission

will facilitate a simpler and quicker resolution process and approach than

traditional regulatory channels.

From 2013 to now, The Financial Commission's services have covered millions

of traders worldwide, providing professional consultation opinions for a total

of 9,395 disputes, and providing additional protection of up to 20,000 euros for

each investor, with a cumulative payout of 51,621,096 dollars.

Second, the world's top regulation

EBC has long been committed to building the optimal whole of security, and is

determined to redefine the standard of security, EBC believes that security is

not only the known scope of the full effort, but also proactive.

With the core team's more than 30 years of deep market deposits, strong

financial strength and strict self-management standards, EBC has passed the

British and Australian top-level dual regulatory audit, and cooperation with

legal compliance and top financial auditing organizations, regularly submit

professional audit reports and accept the FCA and ASIC's full authority to supervise the whole process(EBC Financial Group (UK) Ltd is authorized and regulated by the Financial

Conduct Authority (FCA) of the United Kingdom, and the Financial Conduct

Authority (FCA) of the United Kingdom. EBC Financial Group Ltd is authorized and

regulated by the Financial Conduct Authority (FCA) of the United Kingdom,

Regulatory No. 927552; EBC Financial Group (Australia) Pty Ltd is authorized and

regulated by the Australian Securities and Investments Commission (ASIC) of

Australia, Regulatory No. 500991).

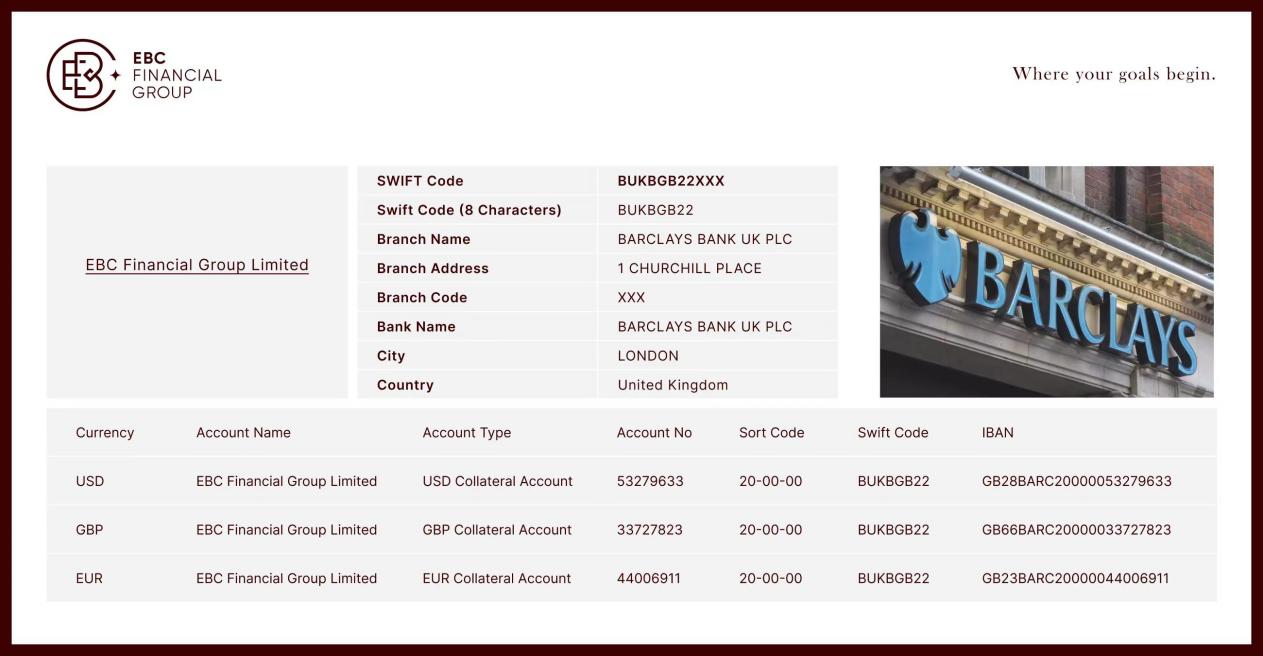

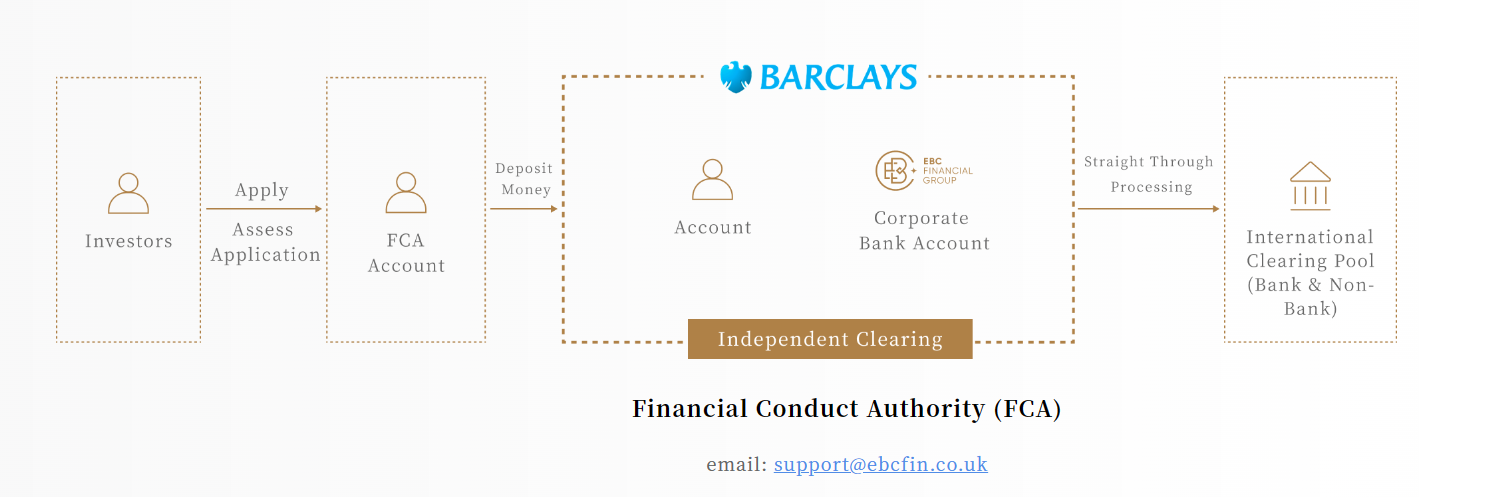

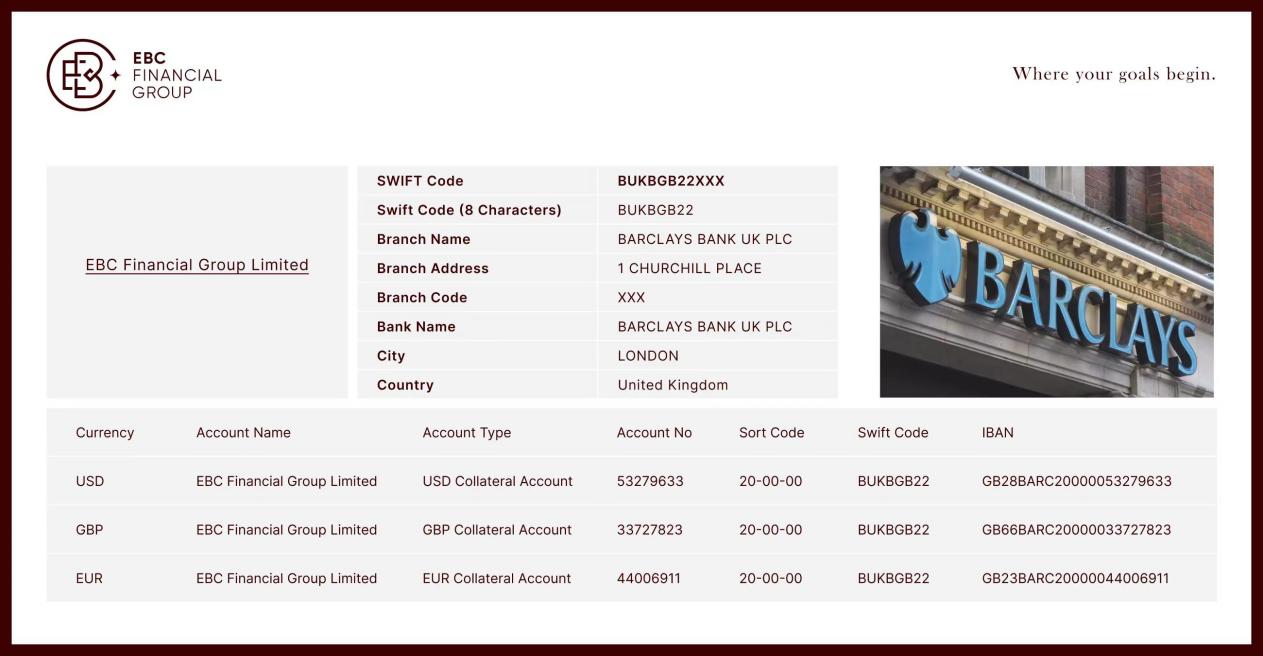

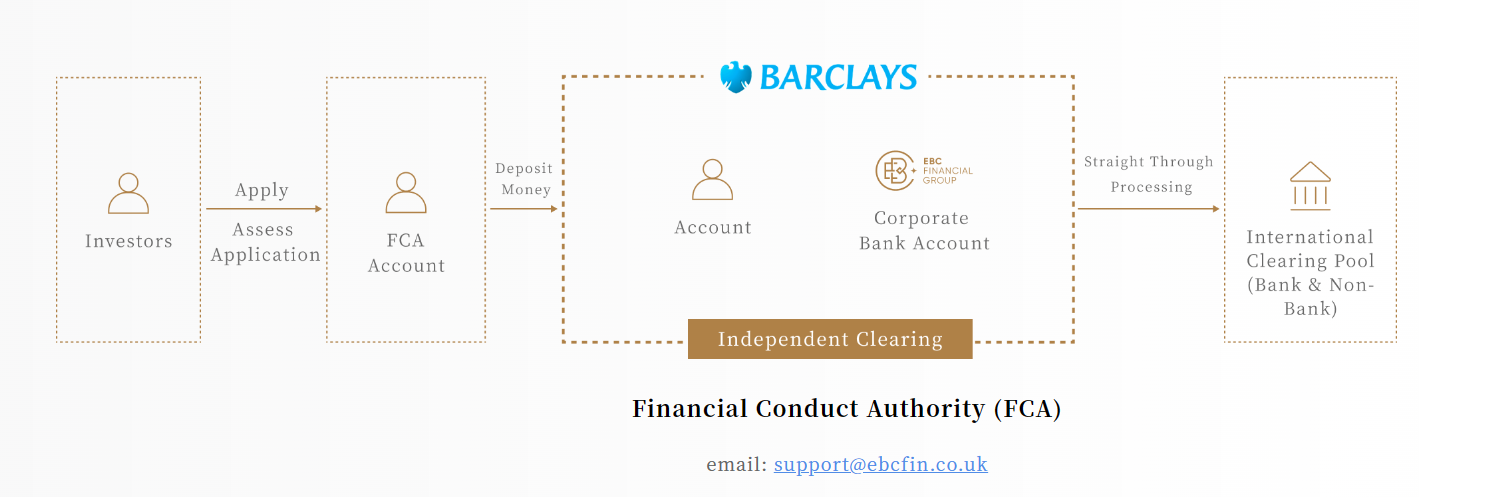

At the same time, EBC has the highest authority of Barclays Corporate Banking

Account, client funds are independently stored in the custody account of

Barclays Bank, EBC UK strictly enforces the provisions of the CASS, and

specifically signed a specific letter of trust, to ensure the safety and

independence of each client's funds.

Currently, EBC is one of the few financial brokerage firms in the market that

can open 100 times and above FCA liquidity clearing accounts, while the FSCS

compensation plan provides EBC with a maximum of 85,000 pounds of compensation

protection for each FCA client.

Third, peace of mind to comprehensive protection

In order to protect the safety and rights of partners' funds in all aspects

and isolate the risk of market uncertainty, EBC purchases professional liability

insurance with an insured amount of more than ten million dollars every year

from Lloyd's of London and Aon (AON) in the United States.

Note* Professional Liability Insurance: The insurer will provide full

reimbursement for user losses and claims caused by possible negligence or errors

of the insured party in the course of providing services.

With over 300 years of history, Lloyd's has a century of experience in

professional underwriting. Aon, on the other hand, is the world's largest

reinsurance broker, providing superior risk management. During the period of

coverage, all subscribers are protected by ongoing, specialized programs

provided by insurance experts.

Peace of mind so that comprehensive coverage is the way to safety.

In the pursuit of ultimate safety, EBC always keEPS an empty cup in mind,

examines every aspect of the service process, draws on new ideas, and combines

specialized knowledge and experience to provide a more diversified and safer

experience for every client.

EBC always believes that only time allows you to know me better.