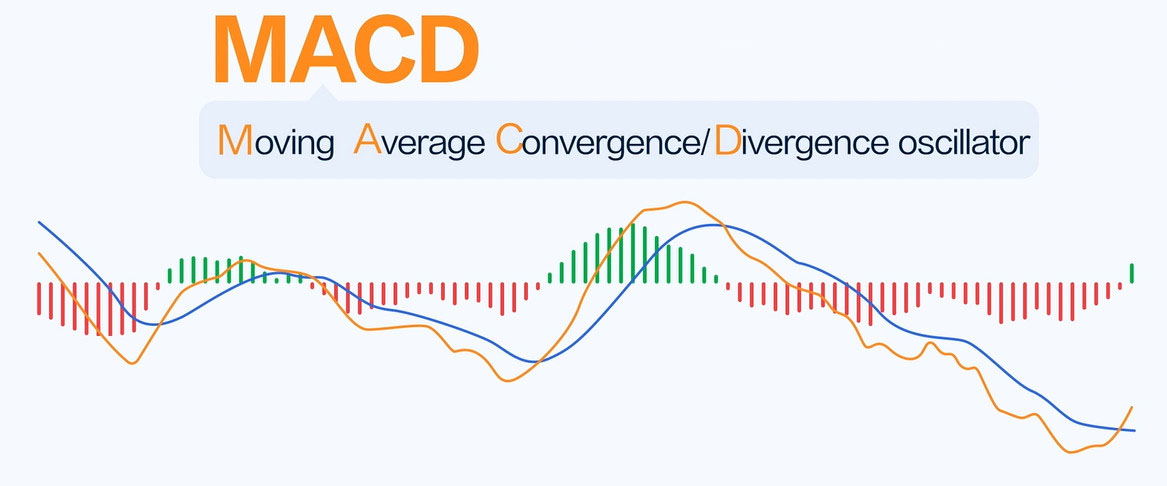

MACD should first calculate the fast (usually 12 days) Moving Average value

and the slow (usually 26 days) moving average value in the application. Use

these two values as the basis for measuring the "difference value" between the

two (fast and slow lines).

The so-called "difference value" (DIF) refers to the 12 day EMA value minus

the 26 day EMA value. Therefore, in the sustained upward trend, the 12th EMA is

above the 26th EMA. The positive deviation value (+DIF) between them will become

larger and larger. On the contrary, in a downward trend, the difference value

may become negative (-DIF) and also increase.

As for the degree to which the positive or negative deviation value needs to

be reduced when the market starts to turn around, it is truly a signal of market

reversal. The reversal signal of MACD is defined as the 9-day moving average

(9-day EMA) of the "difference value".

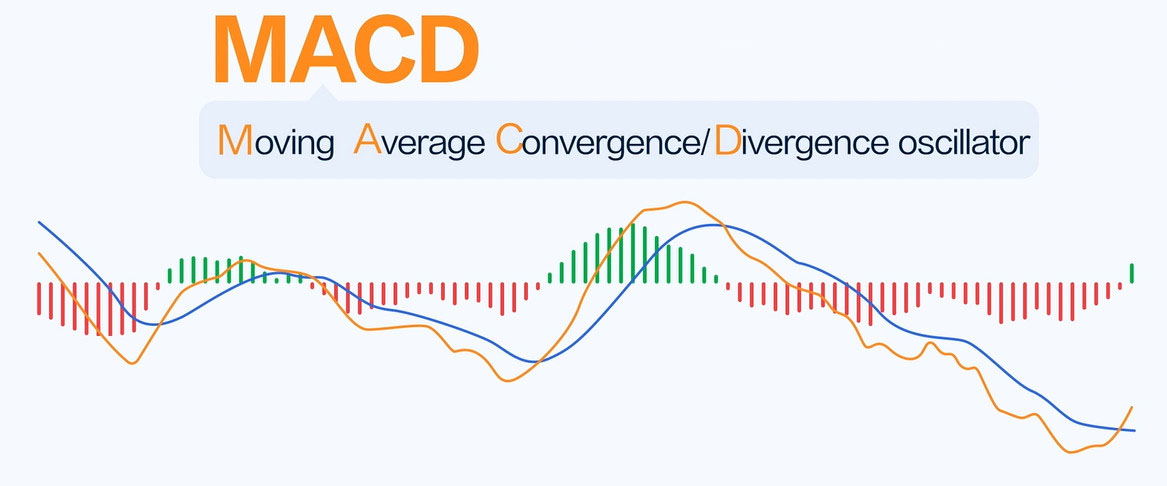

The calculation formula for MACD indicators involves three parts: a fast

line, a slow line, and a bar chart.

1. Calculate the fast line (EMA12).

Firstly, it is necessary to calculate the 12-day average index (EMA12) of the

closing price, which is:

EMA12=Previous day EMA12 x 11/13+ Today's closing price x 2/13

Among them, 11/13 and 2/13 are weighting coefficients that can be adjusted

according to different analysis requirements.

2. Calculate the slow line (EMA26).

Next, it is necessary to calculate the 26-day average index (EMA26) of the

closing price, which is:

EMA26=Previous day EMA26 x 25/27+ Today's closing price x 2/27

Similarly, 25/27 and 2/27 are weighted coefficients.

3. Calculate bar charts (DIF and DEA).

Finally, the difference between the fast and slow lines can be used as a bar

chart (DIF) to measure price momentum and trend changes while also calculating

the 9-day moving average (DEA) of the DIF, which is:

DEA=previous day's DEA x 8/10 + today's DIF x 2/10

Finally, the calculation formula for MACD indicators can be expressed as:

MACD=DIF-DDEA

Its IF is the difference between the fast line and the slow line, DEA is the

9-day moving average of DIF, and MACD is the bar chart. It should be noted that

the value of the MACD index can be positive, negative, or zero, and its size and

direction reflect the change and trend intensity of market prices.