U.S. stocks slouched to a higher close on Monday, and benchmark Treasury

yields rose amid flickering optimism that Washington will get past partisan

wrangling and reach a debt ceiling deal.

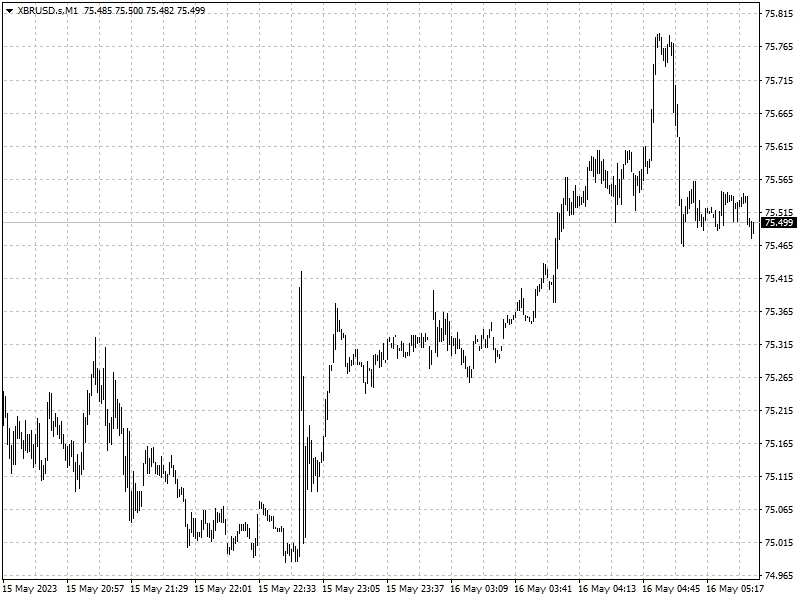

The greenback backed down after touching a five-week high, consolidating

gains. Gold edged higher in opposition to the weakening dollar.

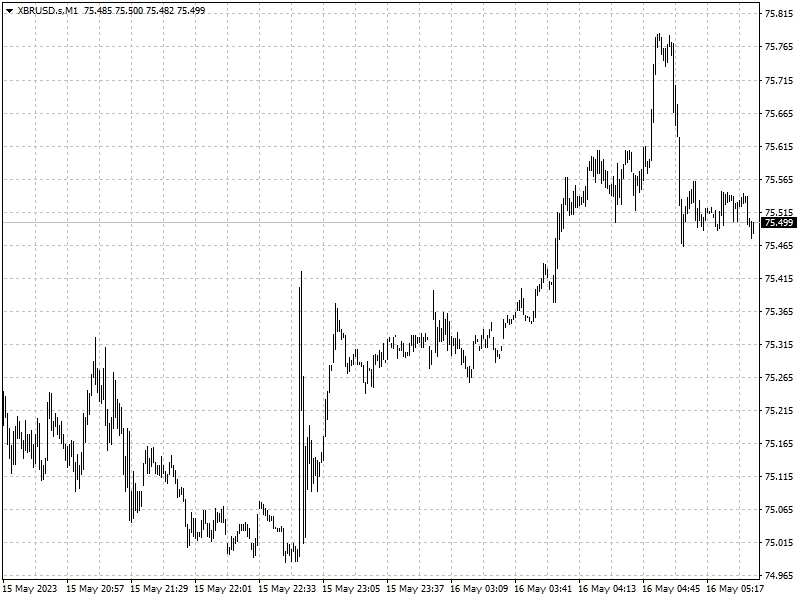

Oil prices rose a dollar a barrel on Monday. At least 300,000 barrels of oil

equivalent per day production was shut in last week in Alberta.

Commodities

U.S. oil output from the seven biggest shale basins is due to rise by 41,000

bpd in June to the highest on record, data from the EIA showed on Monday.

‘If credit conditions ease over the coming months, allaying economic fears

for the world's largest economy, oil prices could bounce back without assistance

but it seems a little premature at this point,’ said OANDA analyst Craig

Erlam.

Forex

President Joe Biden is scheduled to meet with congressional leaders on

Tuesday for face-to-face talks, a day before he leaves for a meeting of the

Group of Seven nations in Japan.

Though the two sides did not appear close to an agreement, the White House

has not ruled out the annual spending caps that Republicans say must accompany

any increase in the nation's $31.4 trillion debt limit.

In emerging markets, the Turkish lira sank to a near record low as weekend

elections looked headed for a runoff.

‘The market is in consolidation mode and waiting for clearer signals from

Washington on how they're going to avert a U.S. default,’ said Amo Sahota,

director at FX consulting firm Klarity FX in San Francisco.

‘I don't think there are key market levels that have been broken. Euro/dollar

is still above $1.08. On Friday, it was threatening to drop below $1.08. The

pound is still at $1.25,’ he added.