CFD crude oil trading has gained significant popularity among traders looking to capitalise on price movements without owning the physical commodity. A Contract for Difference (CFD) allows traders to speculate on the rise or fall of crude oil prices without taking delivery of the oil itself. This method offers flexibility, leverage, and access to global markets, making it a favourite among both novice and experienced traders.

Trading CFD crude oil means entering a contract where the difference between the opening and closing prices is exchanged. If the price moves in your favour, you profit; if it moves against you, you incur a loss. This straightforward setup means traders can potentially benefit from both rising and falling markets.

Why Choose CFD Crude Oil?

One of the biggest attractions of CFD crude oil trading is its accessibility. Unlike physical oil markets, CFDs require lower capital outlay, thanks to leverage. This means traders can control larger positions with a smaller amount of money. However, leverage can magnify losses as well as gains, so risk management is vital.

Another advantage of CFD crude oil trading is the ability to trade 24 hours a day, reflecting the global nature of oil markets. This flexibility allows traders to respond to news, geopolitical events, and economic data releases that affect oil prices in real time.

Additionally, CFD crude oil trading provides exposure to a commodity that is a key driver of the global economy. Fluctuations in oil prices can influence inflation, production costs, and even geopolitical stability, making it an exciting market for traders.

How Does CFD Crude Oil Pricing Work?

The pricing of CFD crude oil is closely linked to global benchmark prices, such as Brent Crude and West Texas Intermediate (WTI). These benchmarks reflect supply and demand dynamics, geopolitical events, and macroeconomic factors. Brokers offering CFD crude oil typically base their prices on these underlying markets, with a small markup or spread.

It's important for traders to understand that CFD prices are not the same as spot prices for physical crude oil, though they closely track them. Factors like broker fees, overnight financing costs, and liquidity can affect CFD crude oil pricing.

Essential Strategies for CFD Crude Oil Trading

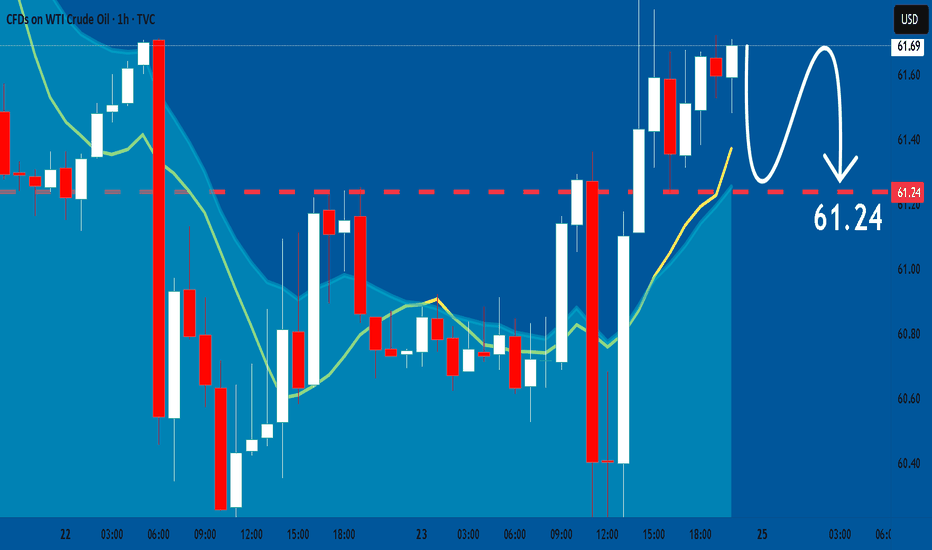

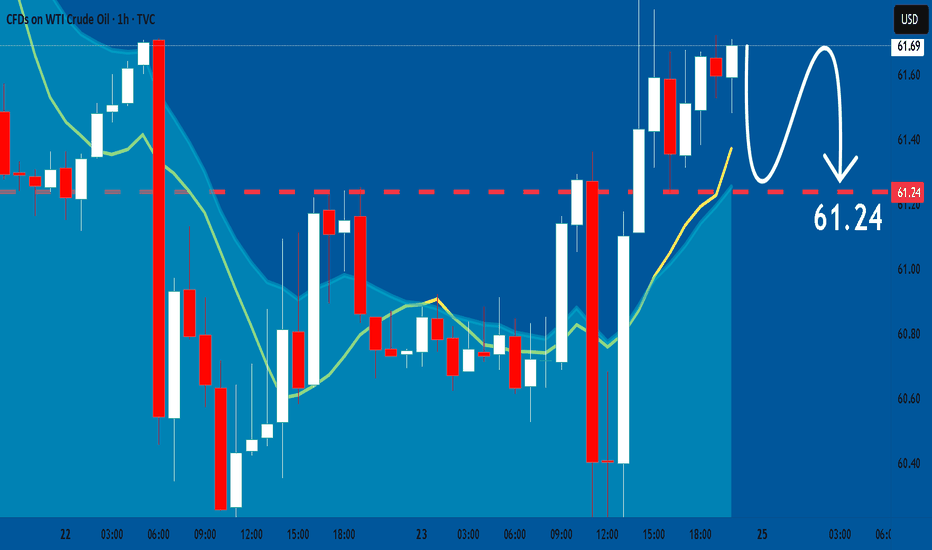

When trading CFD crude oil, beginners should focus on strategies that emphasise risk management and market analysis. Technical analysis tools such as moving averages, trend lines, and momentum indicators can help identify potential entry and exit points.

Fundamental analysis is equally important. Keeping an eye on global events such as OPEC meetings, geopolitical tensions, and economic reports can provide insight into upcoming price movements.

Due to the volatile nature of crude oil prices, stop-loss orders and position sizing are critical to protect capital. Traders should avoid overleveraging and ensure they only risk a small percentage of their account on each trade.

Risks Involved in CFD Crude Oil Trading

While CFD crude oil trading offers many opportunities, it also carries significant risks. The use of leverage means that losses can exceed initial deposits, which makes risk management essential. Sudden price swings caused by geopolitical unrest or unexpected economic news can lead to rapid losses.

Another risk is market manipulation or broker practices that can affect pricing and execution. Traders should choose regulated brokers with transparent pricing to minimise these risks.

Market volatility can also lead to slippage, where trades are executed at a different price than expected. This can impact profitability, especially for short-term traders.

Tips for Beginners Trading CFD Crude Oil

For beginners, the first step is to educate yourself about how CFD crude oil markets operate. Demo accounts offered by brokers provide a risk-free way to practice trading strategies.

Building a trading plan with clear rules for entry, exit, and risk control is crucial. Emotional discipline is key to avoid chasing losses or making impulsive trades.

Staying updated with global news that affects oil prices helps anticipate market moves. Combining both technical and fundamental analysis provides a more comprehensive trading approach.

Finally, start small. Using low leverage and trading smaller positions reduces the risk of large losses while you gain experience.

The Role of Technology in CFD Crude Oil Trading

Modern trading platforms have made CFD crude oil trading more accessible than ever. Features like real-time charts, technical indicators, and risk management tools help traders make informed decisions.

Mobile trading apps allow monitoring and adjusting positions on the go, which is important given the 24-hour nature of oil markets.

Copy trading and social trading platforms can also be valuable for beginners, offering opportunities to follow experienced traders and learn from their strategies.

Conclusion

CFD crude oil trading provides an exciting opportunity for traders to engage with a vital global commodity without the need for physical ownership. Understanding how the market works, managing risk carefully, and combining analysis methods are key to success.

Beginners should focus on learning and practicing before committing significant capital, using tools and resources available through reputable brokers. CFD crude oil trading is not without risk, but with discipline and knowledge, it can be a rewarding addition to any trading portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.