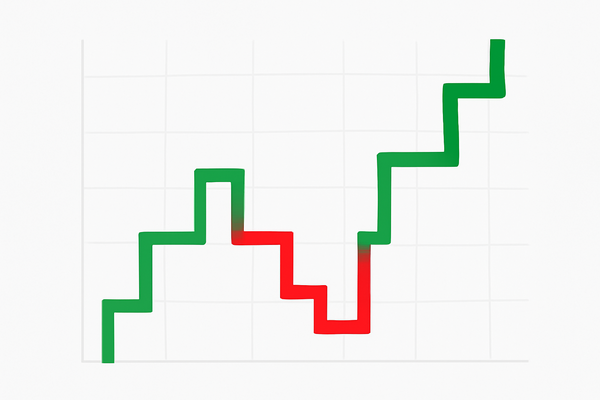

Forex reverse tracking is an investment strategy that differs from traditional tracking strategies. In traditional trading strategies, investors develop their own trading plans based on the trading behavior of other traders. In the reverse tracking strategy, investors will adopt the opposite trading behavior, that is, if other traders long a certain currency pair, the reverse tracking investor will short that currency pair.

Although reverse tracking may seem like an effective hedging tool, it may not necessarily be profitable. Firstly, reverse tracking is only a reverse operation, so it does not change the basic trend of the market. If the market rises, then short trades will lose money. The reverse is also true.

Secondly, reverse tracking requires investors to have high analytical and judgmental abilities. Investors need to accurately predict market trends and take opposite trading actions at appropriate times. This is very difficult for ordinary investors because they lack professional technical knowledge and experience.

Finally, reverse tracking also needs to consider cost issues. Reverse tracking requires payment of commissions and spreads, which can increase transaction costs and reduce profitability potential.

So can reverse copying make money? The answer is that it is possible to make money, but it is not absolute. Here are some factors to consider:

1. Market trend: If the market as a whole is in an upward or downward trend, the risk of adopting a reverse tracking strategy is higher. Because in this situation, reverse tracking investors who hold opposite views to most traders are easily impacted by market trends.

2. Technical analysis and fundamental analysis: Reverse tracking investors need to have strong technical and fundamental analysis abilities. They need to assess market trends and adopt opposite trading strategies at appropriate times.

3. Choosing the correct trading platform: Reverse tracking investors need to choose a reliable online trading platform. They need to check the platform's commission, spread, fund security and other information to ensure that the platform can provide high-quality transaction services.

4. Risk control: Reverse tracking investors need to take effective risk control measures. They need to set stop loss and stop profit points to avoid excessive losses or missed opportunities to make money.

In short, forex reverse tracking can be an effective hedging tool, but it may not necessarily be profitable. Investors need to possess excellent analytical and judgmental abilities, and consider factors such as transaction costs.

Reverse tracking is a forex trading strategy that operates in the opposite direction based on the trading behavior of other investors. Under the premise of correctly selecting platforms, mastering technical and fundamental analysis, and taking effective risk control measures, reverse tracking may bring profits.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.