Yen weighed down by brighter US outlook

2025-05-13

Summary:

Summary:

The yen fell Tuesday as the dollar rose after trade war eased. U.S. tariffs on Chinese goods drop from 145% to 30%, China’s to 10% from 125%.

The yen dipped on Tuesday on a stronger dollar following trade war

de-escalation. The US will lower tariffs om Chinese goods from 145% to 30%,

while China's retaliatory tariffs will drop to 10% from 125%.

Japan's bank deposits increased at the slowest pace since April 2007 as

households seek to safeguard their assets from inflation. Figures also show an

increase in demand for riskier assets.

Real wages decreased for a third consecutive month in March, squeezed by

relentless inflation, although consumer spending overshot expectations,

government data showed.

An internal affairs ministry official said increases in utilities and

entertainment spending had contributed to the increase, adding there were signs

consumption had picked up in recent months.

The export-reliant economy is facing tariff threats and uncertainty over

monetary policy. Economists are expecting to see a contraction in Q1 GDP next

week after an expansion of 2.2% in the previous quarter.

PM Shigeru Ishiba on Monday signalled that increasing corn imports from the

US would be among options in trade negotiations with Washington. Japan has made

little headway in the talks.

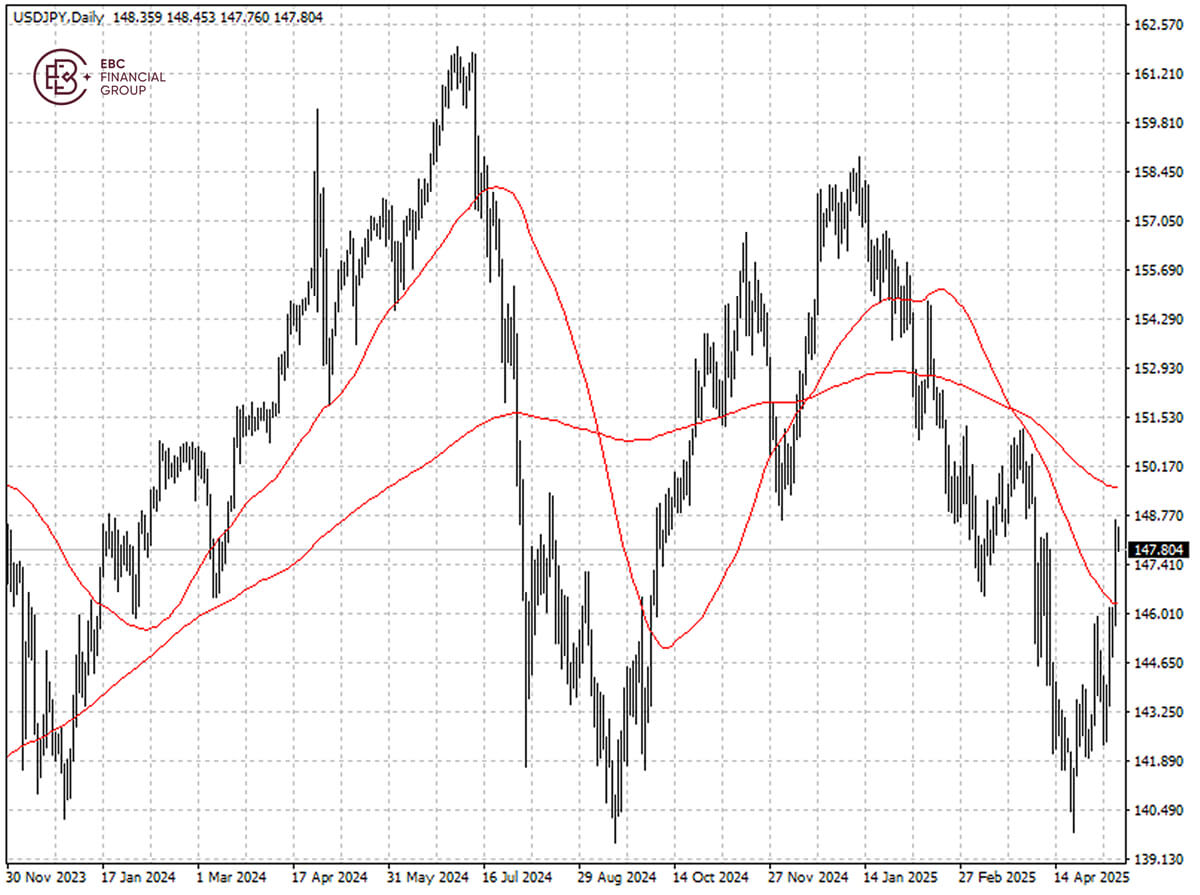

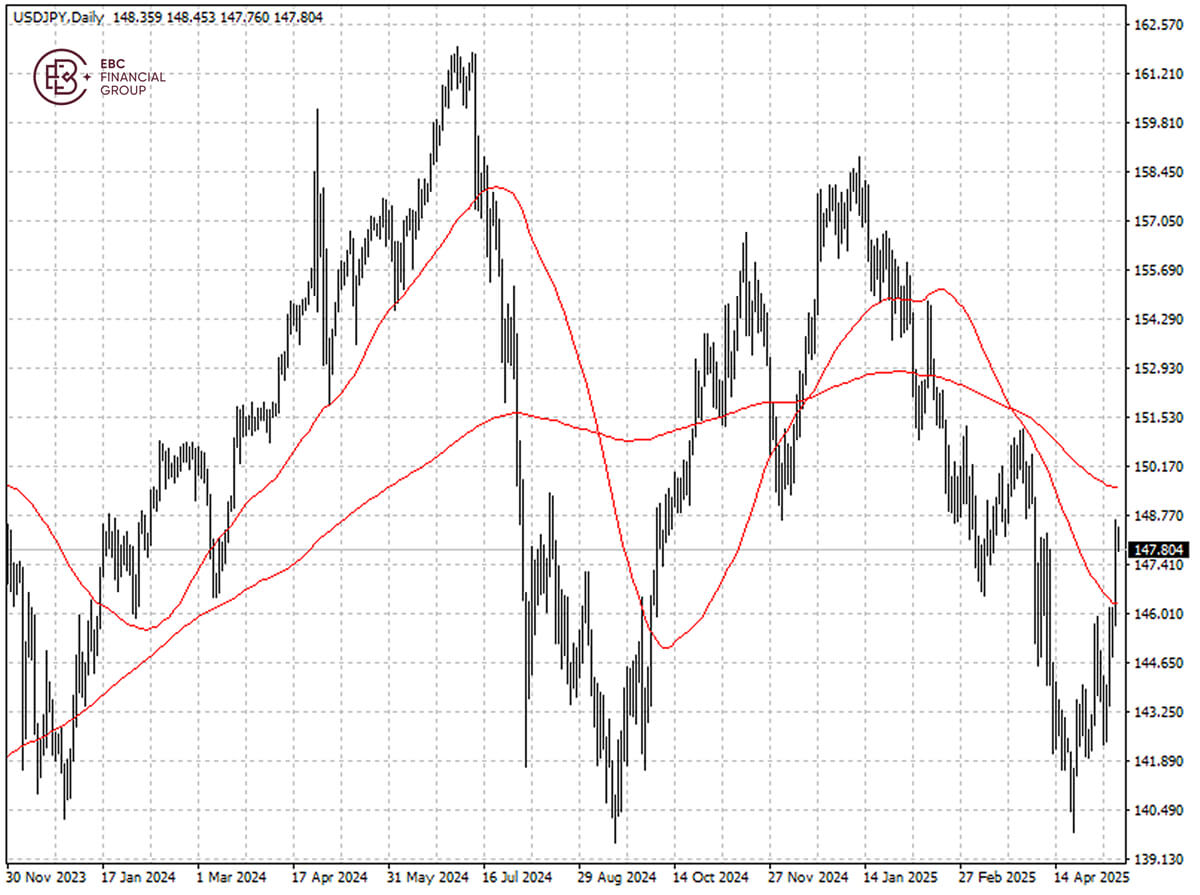

Breaking below 50 SMA, the yen is heading towards 200 SMA. Lower highs and

lower lows indicate that the downtrend will likely continue, but 150 per dollar

may provide some support.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.