Wall St eases with Trump targeting Apple

2025-05-26

Summary:

Summary:

US stocks fell Friday after a strong rally, as focus shifted to tax and spending plans that may further increase federal debt.

US stocks pulled back on Friday after a torrid rally, as markets turned their

attention to tax and spending legislation poised to swell the federal

government's already massive debt.

An earnings report from Nvidia will take centre stage for Wall Street in the

coming week, as stocks hit a speed bump of worries over federal deficits driving

up Treasury yields.

The company is set to launch a new AI chipset for China amid export curbs,

Reuters reported on Saturday, with mass production likely to begin as early as

next month.

Hedge funds slashed their exposure to US Big Tech stocks in early 2025 and

rotated into Chinese equities which remain undervalued, according to Goldman

Sachs' latest Hedge Fund Trend Monitor.

The report shows a shift away from the Magnificent 7 stocks and into China

ADRs, such as Alibaba, Baidu and JD. Meanwhile, exposure to AI-related stocks

were steady, which may stem losses.

China-listed Apple supplier stocks lost ground after Trump threatened tariffs

on imported iPhones. He warned that he may slap a 25% levy on any iPhones sold,

but not made, in the US.

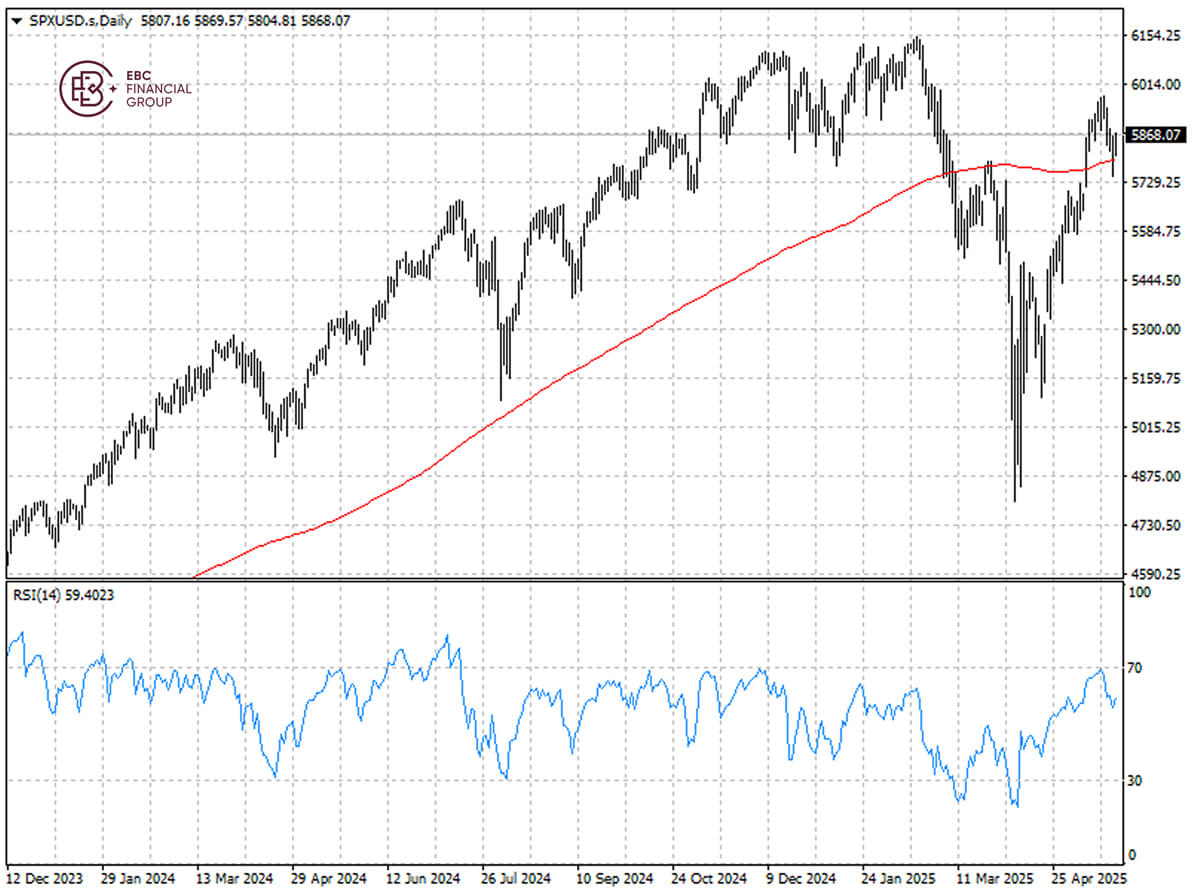

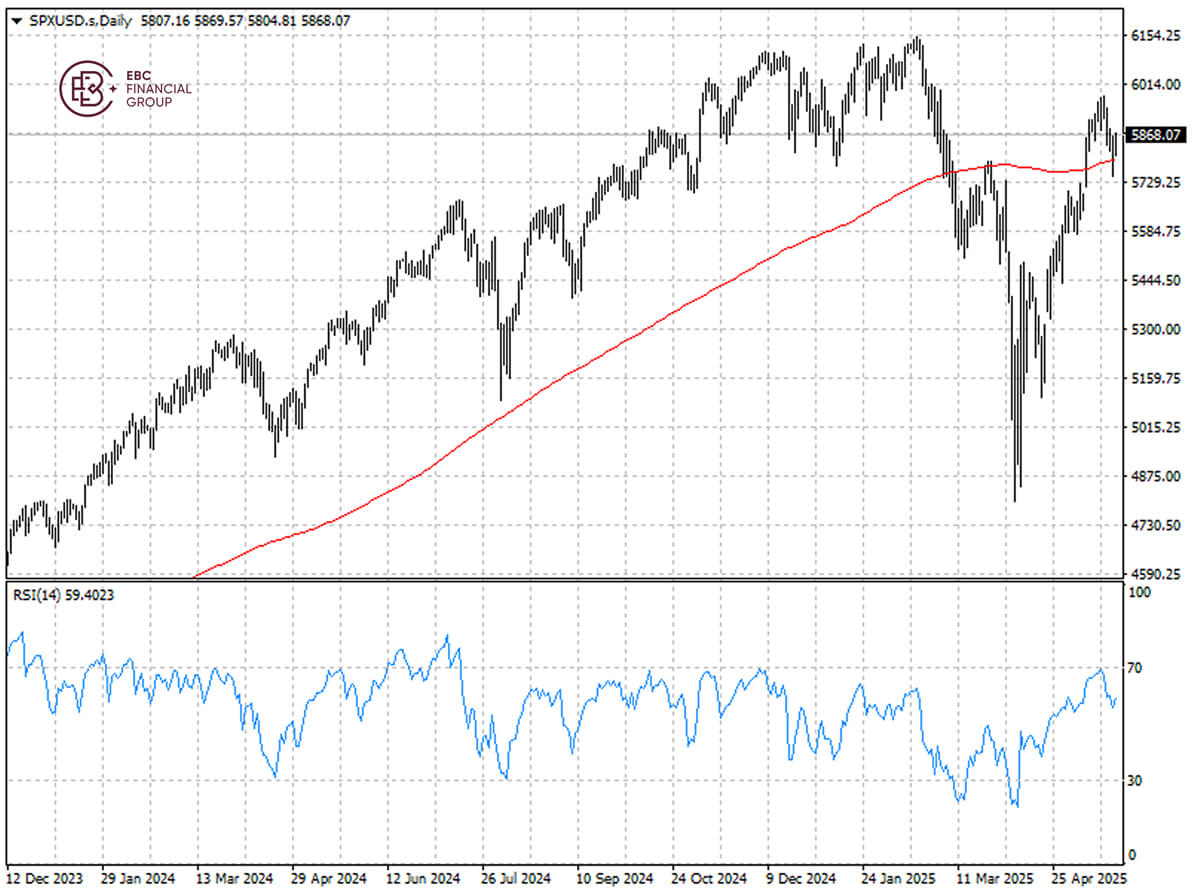

The S&P 500 dipped below 200 SMA with RSI retreating from the overbought

territory. It looks neutral and buying the dip could be a safer bet.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.