In the complex world of trading, having reliable tools that help identify market trends is essential. Among these tools, the Vortex Indicator has gained popularity for its ability to capture the start and end of trends with clarity.

This article explores 5 key reasons traders rely on the Vortex Indicator to make smarter trading decisions.

What Is the Vortex Indicator?

Before diving into why traders trust it, let's briefly explain what the Vortex Indicator is. The Vortex Indicator is a technical analysis tool developed to detect the beginning and continuation of trends. It consists of two lines that represent positive and negative trend movements.

When these lines cross or diverge, they signal potential trend reversals or confirmations, making it easier for traders to understand market momentum.

5 Reasons Traders Rely on the Vortex Indicator

1. Clear Identification of Trend Direction

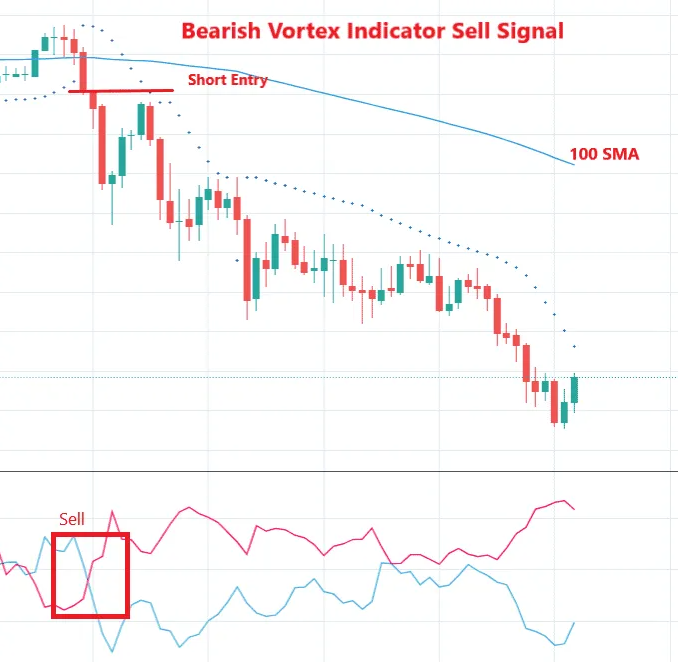

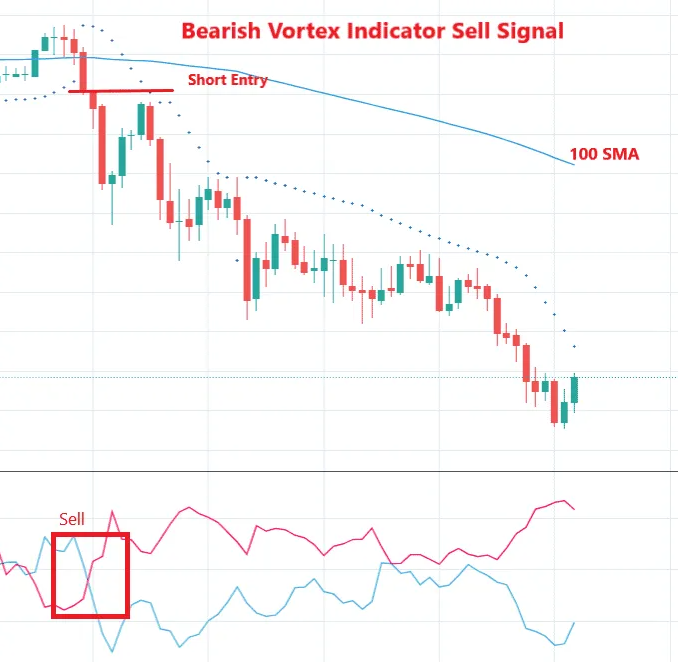

One of the main advantages of the Vortex Indicator is its ability to clearly signal whether a market is trending upwards or downwards. Unlike other oscillators that might give ambiguous signals during sideways markets, the Vortex Indicator's two distinct lines offer a straightforward reading. When the positive trend line crosses above the negative, it suggests a bullish trend. Conversely, a crossover where the negative line moves above the positive line indicates a bearish trend.

This clarity is vital for traders looking to enter or exit positions with confidence. By quickly identifying the trend direction, traders can avoid false signals that often plague other technical indicators.

2. Early Detection of Trend Reversals

Timing is everything in trading. The Vortex Indicator helps traders spot early signs of trend reversals before they become apparent on price charts alone. By monitoring the interaction of its two lines, traders can anticipate when the market is losing momentum and prepare for potential changes.

For instance, when the positive and negative lines cross, it signals a possible shift in market sentiment. Traders who act on these early cues can position themselves advantageously, minimising losses and maximising profits.

3. Versatility Across Different Markets and Timeframes

Another reason traders rely on the Vortex Indicator is its adaptability. Whether you trade forex, stocks, commodities, or cryptocurrencies, the Vortex Indicator can be applied effectively. It works well on various timeframes, from minute-by-minute charts for day traders to weekly or monthly charts for long-term investors.

This versatility makes it a valuable addition to any trader's toolkit. No matter the market or strategy, the Vortex Indicator provides consistent insights into trend behaviour, helping traders tailor their approaches.

4. Easy to Combine with Other Technical Tools

Trading rarely relies on a single indicator. Successful traders often combine multiple tools to validate their decisions. The Vortex Indicator integrates well with other technical analysis methods such as moving averages, RSI, or MACD.

For example, if the Vortex Indicator signals a bullish trend and the RSI confirms momentum is strong but not overbought, traders gain extra confidence in entering a long position. This synergy between tools enhances accuracy and reduces the risk of false entries.

5. Enhances Risk Management and Trade Timing

Effective risk management is crucial in trading, and the Vortex Indicator contributes to this by helping traders time their entries and exits more precisely. By identifying trend strength and direction, it aids in setting stop-loss and take-profit levels that align with market conditions.

Knowing when a trend is losing steam allows traders to tighten stops or take partial profits, thereby protecting gains. Conversely, recognising a strong trend helps maintain positions longer to maximise returns. This improved timing reduces emotional decision-making and helps maintain discipline.

Conclusion

The Vortex Indicator has become a trusted tool for traders seeking to navigate market trends with greater clarity and precision. Its ability to clearly identify trend direction, detect reversals early, adapt across markets and timeframes, integrate with other technical tools, and enhance risk management makes it an indispensable part of many trading strategies.

As markets continue to evolve, incorporating reliable indicators like the Vortex Indicator can help traders stay ahead and make more informed decisions. Whether you are a beginner or an experienced trader, understanding and using the Vortex Indicator can significantly improve your trading performance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.