Dollar nudges lower as U.S. debt ceiling deal boosts confidence

2023-05-30

Summary:

Summary:

European stock indexes edged lower on Monday and euro zone bond yields dropped, but news that the U.S. had reached a debt ceiling deal over the weekend kept Wall Street futures positive.

European stock indexes edged lower on Monday and euro zone bond yields

dropped, but news that the U.S. had reached a debt ceiling deal over the weekend

kept Wall Street futures positive.

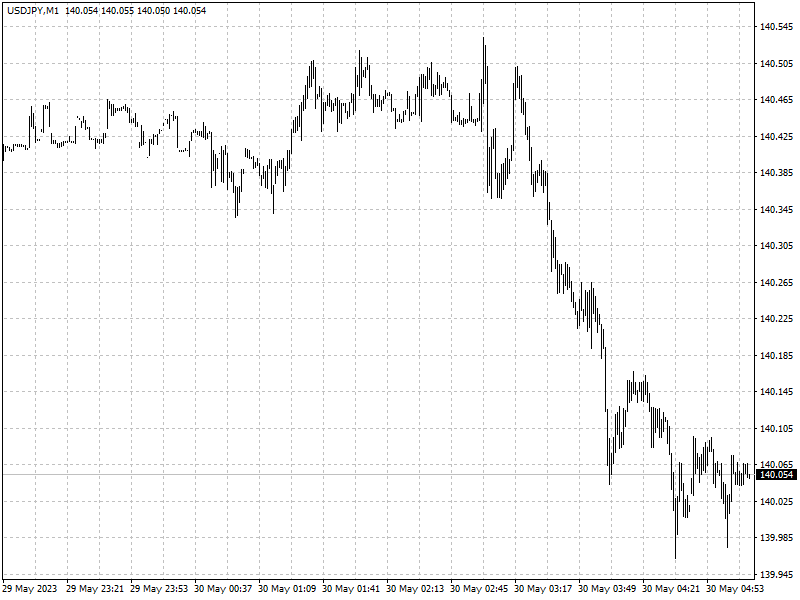

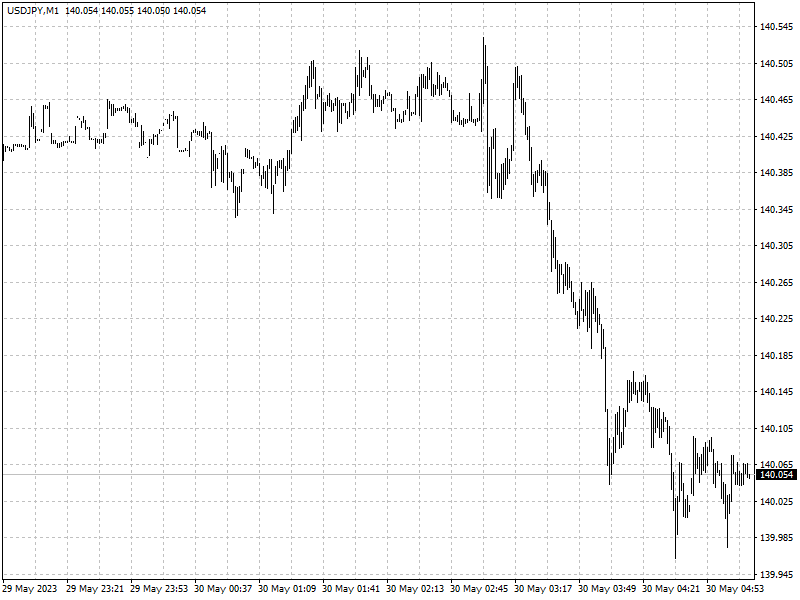

The dollar nudged down, pulling back from six-month peaks against the yen.

Oil prices slipped 1% and gold was little changed, hovering near Friday’s

two-month low.

U.S. President Joe Biden and top congressional Republican Kevin McCarthy

reached a tentative debt ceiling deal on Saturday, aiming to stop the U.S. from

defaulting on its debt.

The deal is expected to provide only short-term relief for markets, as

worries linger about inflation and further rate increases.

Commodities

Markets weighed a tentative U.S. debt ceiling deal that would avert a default

by the world's top oil consumer against further Federal Reserve interest rate

hikes that could curb energy demand.

‘Traders have been left a little confused as to what we can expect,’ said

Craig Erlam, senior markets analyst at OANDA.

‘It may be that Saudi Arabia wants to keep traders on their toes, but to make

these comments and not follow through could be perceived as weak and see prices

drift lower again,’ Erlam said.

Forex

Markets are now pricing in a roughly 50-50 chance that the Fed raises rates

by another 25 basis points at its June 13-14 meeting, up from the 8.3% chance

predicted a month ago, according to CME's FedWatch Tool.

The dollar was on course for a monthly gain of about 3% against the yen. The

dollar index has gained 2.5% in May. Upbeat world sentiment pushed the

risk-sensitive Australian and New Zealand dollars off last week's six-month

lows.