Crude prices down on US crude build

2025-05-22

Summary:

Summary:

Oil prices fell as US crude inventories rose unexpectedly, raising demand fears, while Iran nuclear talks renewed. Benchmark down 13% this year.

Oil prices eased on Thursday as unexpected builds in US crude inventories

raised demand concerns, while renewed Iran nuclear talk also captured attention.

Benchmark contact has been down over 13% this year.

US crude and fuel inventories posted surprise stock builds in the week ended

16 May, the EIA said, as crude imports hit a six-week high and gasoline and

distillate demand slipped.

Washington and Tehran have held several rounds of talks this year over

nuclear programme. Trump has revived a campaign of stronger sanctions on Iranian

crude exports for a quicker deal.

France, Britain and Germany have warned they would reimpose UN sanctions if

no deal emerged quickly. Iran may turn to China and Russia as a "Plan B" if

negotiation is still at a standstill, sources said.

CNN reported on Tuesday that US intelligence suggests Israel is preparing to

strike Iranian nuclear facilities, adding that it was not clear whether Israeli

leaders have made a final decision.

World oil supply will rise more rapidly than previously expected this year as

OPEC+'s gradual output increase is expected to outweigh slowing growth in the US

shale industry, the IEA said last week.

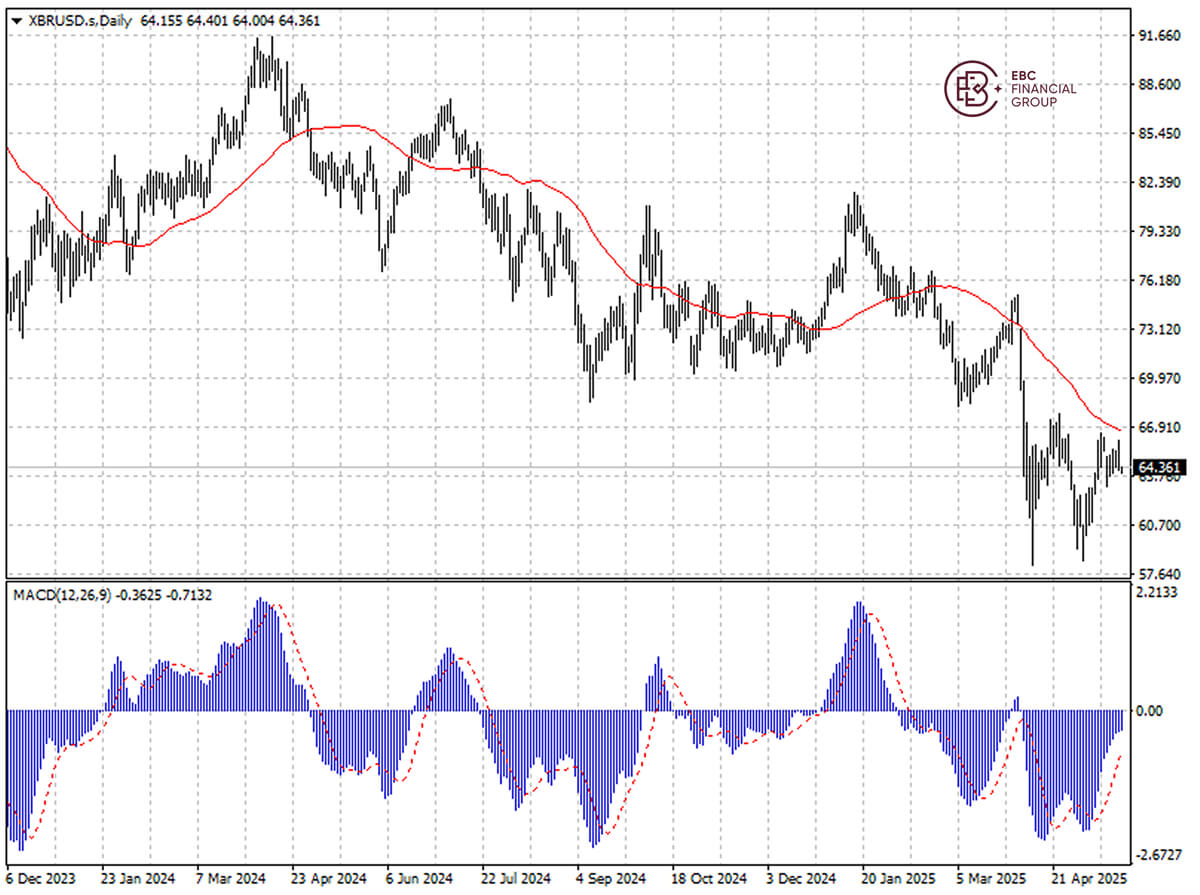

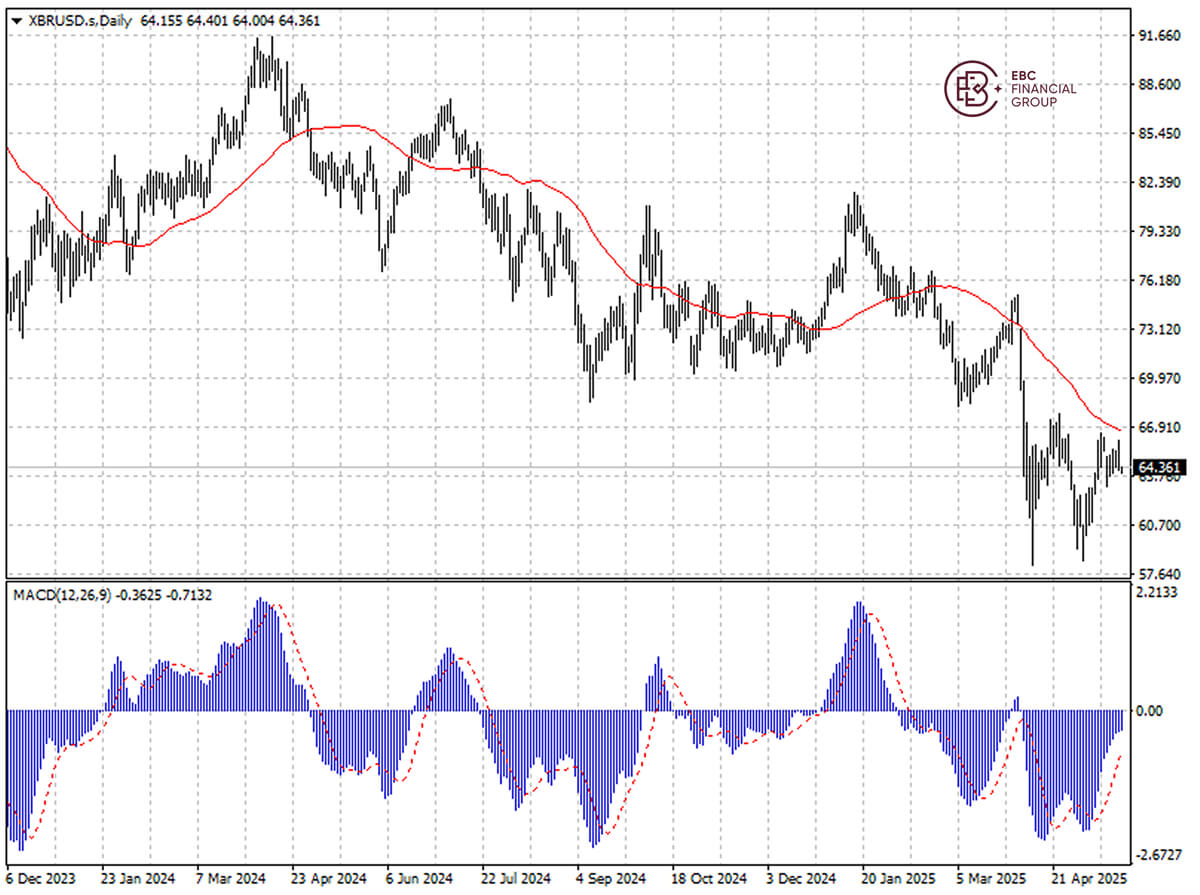

Brent crude is trading below 50 SMA, but bullish MACD divergence indicates

more gains ahead. The major resistance likely lies around $66.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.