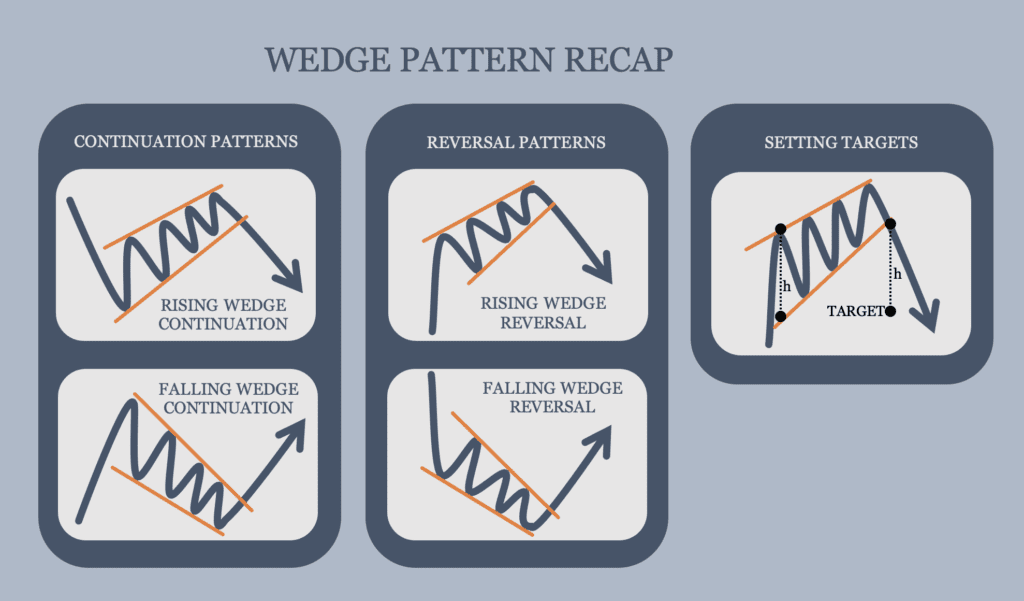

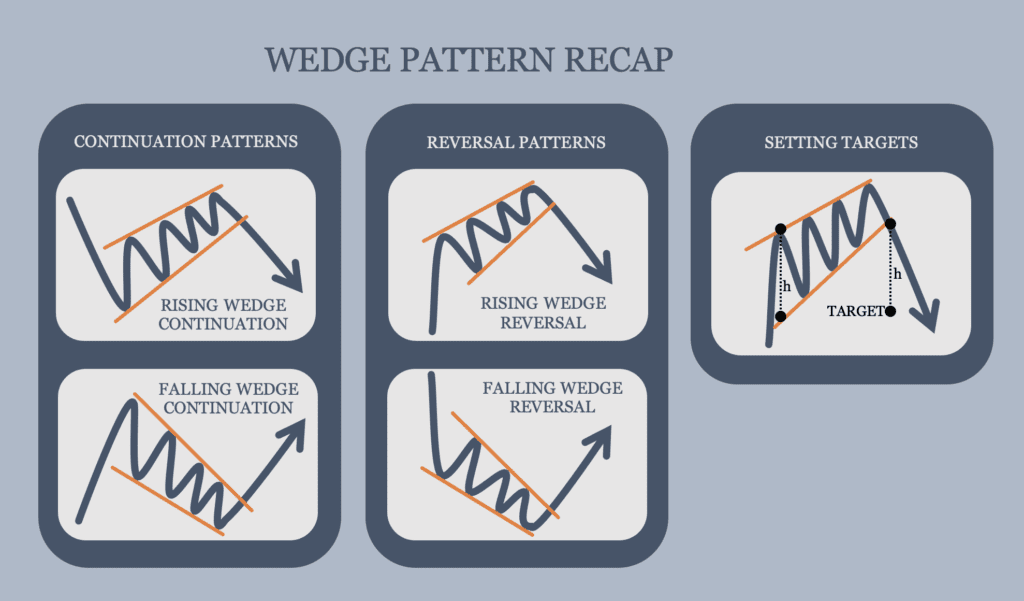

The wedge pattern is one of the most recognised formations in technical analysis, commonly used to forecast potential price breakouts. It appears on charts when price movements tighten into a converging structure, typically indicating a pause or a reversal in trend. Traders usually spot two main types: the rising wedge pattern, which often signals a bearish reversal, and the falling wedge pattern, which may hint at a bullish reversal.

The strength of the wedge pattern lies in its ability to compress market sentiment. As price moves within the narrowing structure, it reflects the tug-of-war between buyers and sellers, often ending in a strong breakout. However, despite its reliability, many traders misuse or misread the wedge pattern, leading to poor results.

Below are six common mistakes traders make when trading the wedge pattern and how to avoid them.

6 Common Mistakes to Avoid in Wedge Pattern Trading

1. Misidentifying the Wedge Pattern

Many traders confuse the wedge pattern with other chart formations like triangles or pennants. While all three involve converging trendlines, the wedge pattern has a distinct slant. In a rising wedge, both support and resistance lines slope upwards, while in a falling wedge, both slope downwards.

Failing to recognise this difference can lead to entering trades based on incorrect assumptions. Always check that the trendlines are converging in the same direction and that the volume typically decreases as the pattern progresses.

2. Ignoring the Larger Trend

The wedge pattern does not exist in isolation. Its context within the broader market trend is crucial. For example, a falling wedge that forms during a long-term uptrend has more bullish potential than one forming in a downtrend.

A common mistake is trading a wedge pattern without considering the prevailing trend. This can lead to false signals or premature entries. Ideally, the pattern should align with the overall direction of the market or serve as a legitimate reversal point after a clear trend exhaustion.

3. Entering Too Early

Impatience can sabotage wedge pattern trades. Traders often enter positions while the price is still moving within the wedge, anticipating a breakout that has not yet occurred. This can result in whipsaw losses if the breakout fails or reverses.

A better strategy is to wait for confirmation. In most cases, a breakout should be accompanied by a rise in volume and a decisive move beyond the pattern's trendlines. Confirming the breakout can significantly increase the probability of success.

4. Misusing Stop Losses

Even when a breakout occurs, markets can retest previous support or resistance levels before continuing in the breakout direction. Traders who place stop-loss orders too close to the breakout point may be prematurely taken out of a trade during this retest.

The solution is to place stop losses beyond logical support or resistance levels, not just above or below the pattern. This allows for normal market noise and protects your position from short-term volatility.

5. Overlooking Volume Patterns

Volume is a key factor in validating a wedge pattern. During the formation of the pattern, volume generally decreases. Then, at the point of breakout, volume should spike as traders pile in.

Ignoring volume changes is a common mistake. A breakout without volume often signals a false move. Always monitor volume closely, as it provides the extra layer of confirmation needed to execute trades with confidence.

6. Relying Solely on the Wedge Pattern

No pattern should be used in isolation, including the wedge pattern. Technical analysis is most effective when multiple tools confirm a signal. Relying solely on the wedge pattern can lead to missed context, such as support/resistance zones, momentum indicators or economic news.

Use other indicators like RSI, MACD or moving averages to confirm your view. Confluence of signals is often the difference between a failed trade and a profitable one.

Why the Wedge Pattern Remains Popular

Despite the pitfalls, the wedge pattern continues to be a favourite among traders for its simplicity and predictive power. When identified correctly and confirmed with other indicators, it can provide high-probability trading opportunities in both bullish and bearish markets.

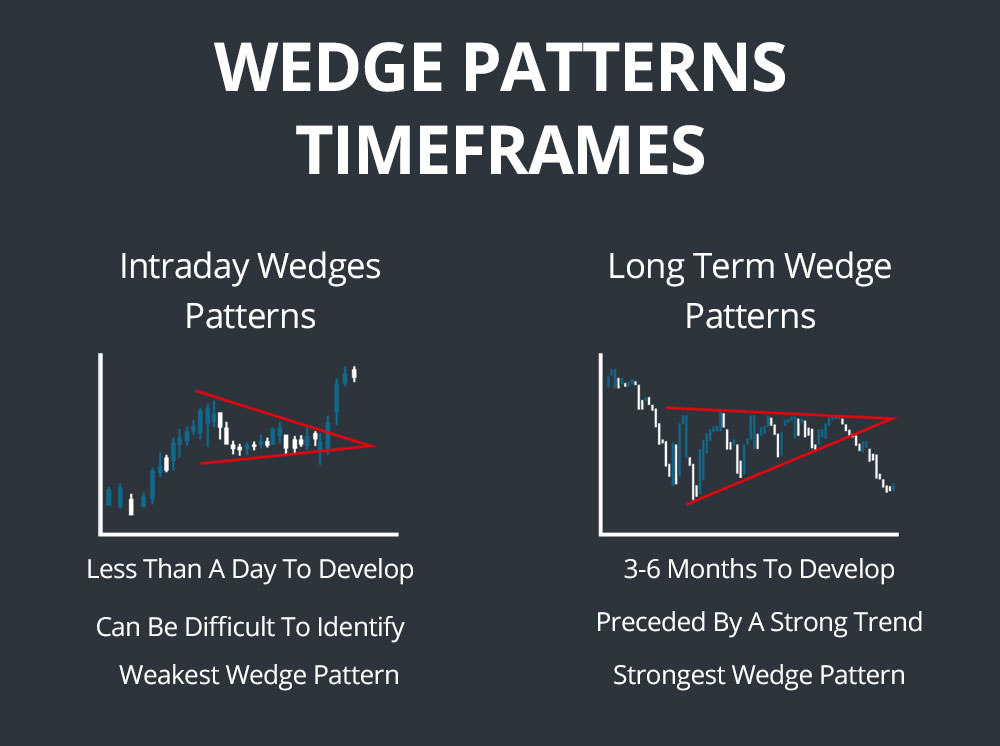

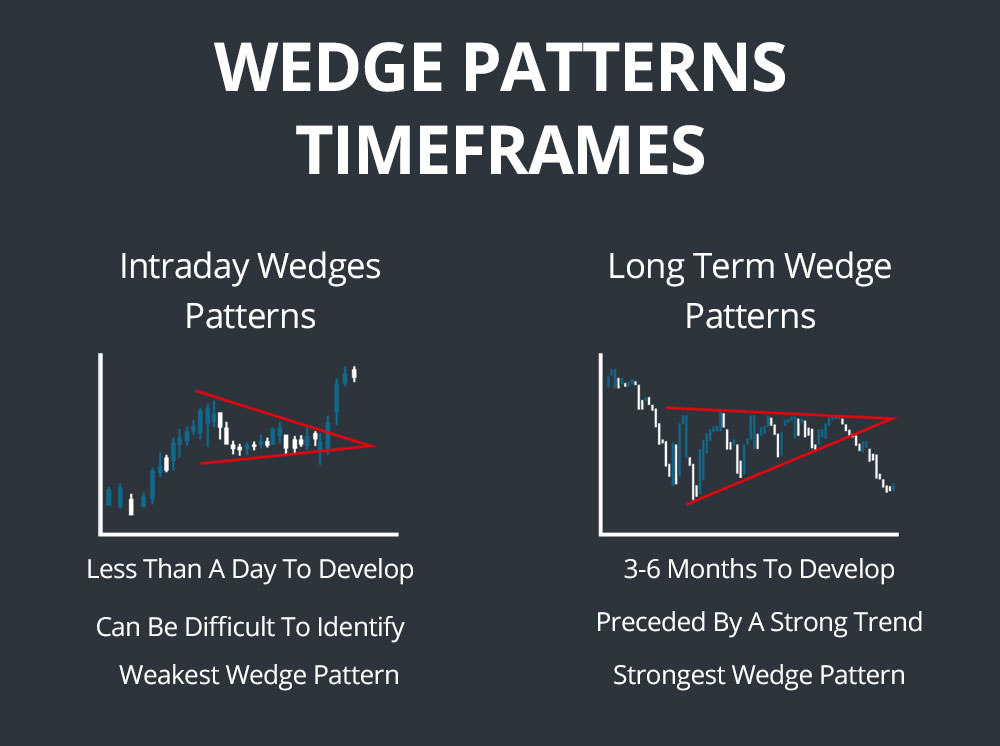

Its appearance across all timeframes also makes it flexible, whether you're day trading, swing trading or investing over the longer term. With a disciplined approach, the wedge pattern can be a valuable tool in any technical trader's arsenal.

Final Thoughts

Avoiding the most common wedge pattern mistakes can significantly improve your success rate. Like all technical tools, the wedge pattern works best when used with patience, confirmation and broader market awareness.

Traders who rush in without verifying breakout signals or who misread chart structures often suffer avoidable losses. On the other hand, those who respect the pattern's limitations and use it as part of a well-rounded strategy are more likely to make consistent gains.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.