Moody’s cut ratings on 10 small- to mid-sized lenders by one notch and placed

six banking giants on review for potential downgrades on Tuesday.

The rating agency warned that the sector’s credit strength would likely be

tested by funding risks and weaker profitability. It came as three U.S. regional

banks collapsed earlier this year.

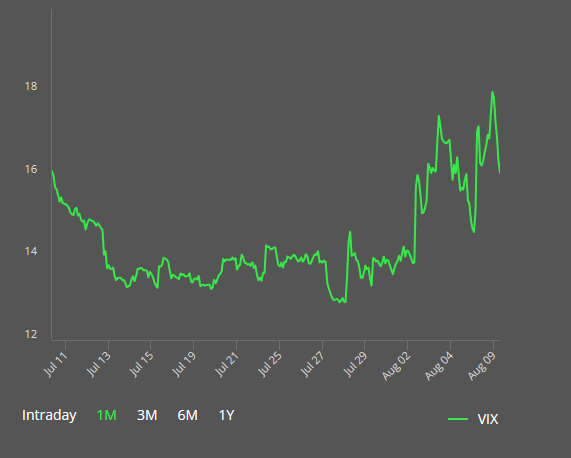

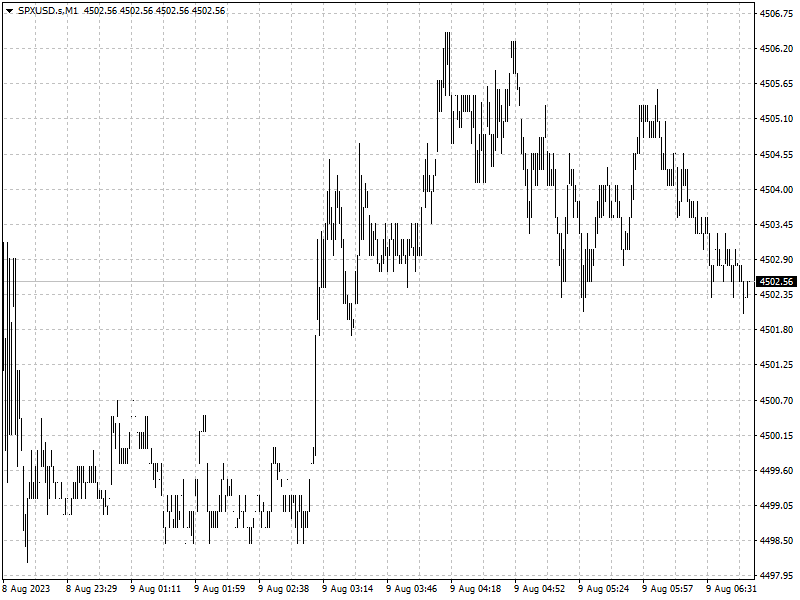

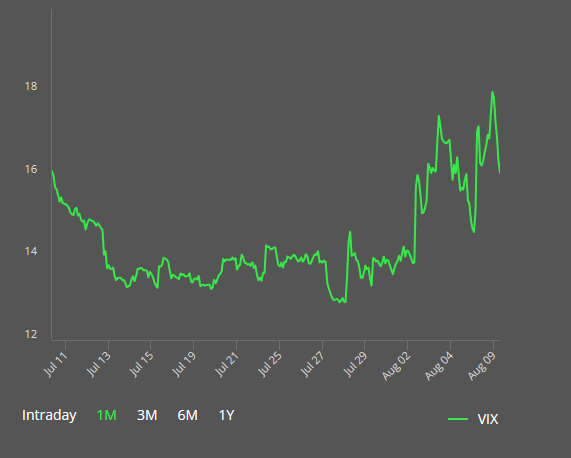

Reaction to the bank downgrades pushed up the CBOE Market Volatility index

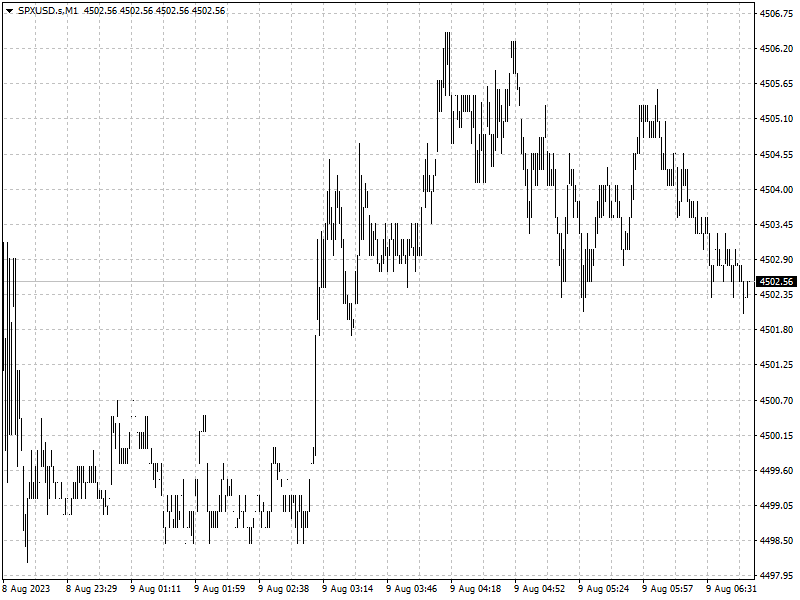

Wall Street's fear gauge, at one point hitting a two-month high. The banks index

slid 1.1%, dragging all three major Wall Street benchmarks lower.

Though authorities went to great lengths to restore confidence, Moody’s

warned that banks with substantial unrealized losses that are not captured by

their regulatory capital ratios may still be susceptible to sudden losses of

market or consumer confidence in a high interest rate environment.

‘Risks may be more pronounced if the U.S. enters a recession – which we

expect will happen in early 2024 – because asset quality will worsen and

increase the potential for capital erosion,’ the analysts added.

Disclaimer: Investment involves risk. The content of this article is not an

investment advice and does not constitute any offer or solicitation to offer or

recommendation of any investment product.