Bad week for bullion with US tariffs challenged

2025-05-29

Summary:

Summary:

Gold prices fell amid improved risk sentiment; court ruled Trump’s tariffs exceeded authority; Chinese gold imports rose sharply.

Gold prices declined for a fourth consecutive session as risk sentiment

improved. The metal had already shown weakness after Brussels said it would

accelerate negotiations with Washington.

A federal court ruled Wednesday that Trump exceeded his authority with his

reciprocal tariffs, dealing a blow to a major tenet of his economic agenda which

has been roiling global markets.

The judges do not see a clear connection between emergency and tariffs in

place. The Trump administration swiftly appealed the ruling Wednesday to the US

Court of Appeals for the Federal Circuit.

Implementing tariffs typically requires congressional approval, but Trump

chose to declare a national economic emergency to bypass it. Washington is

having trade talks with several countries.

Trump's pivot to champion Nippon Steel bid to buy US Steel raises the

prospect of fresh positive momentum for Japan. The Asian country tariffs bears

the brunt of car tariffs.

Chinese gold imports hit an 11-month high in April as prices continued to

surge to record levels. This came in the wake of the PBoC raising gold import

quotas to meet surging demand.

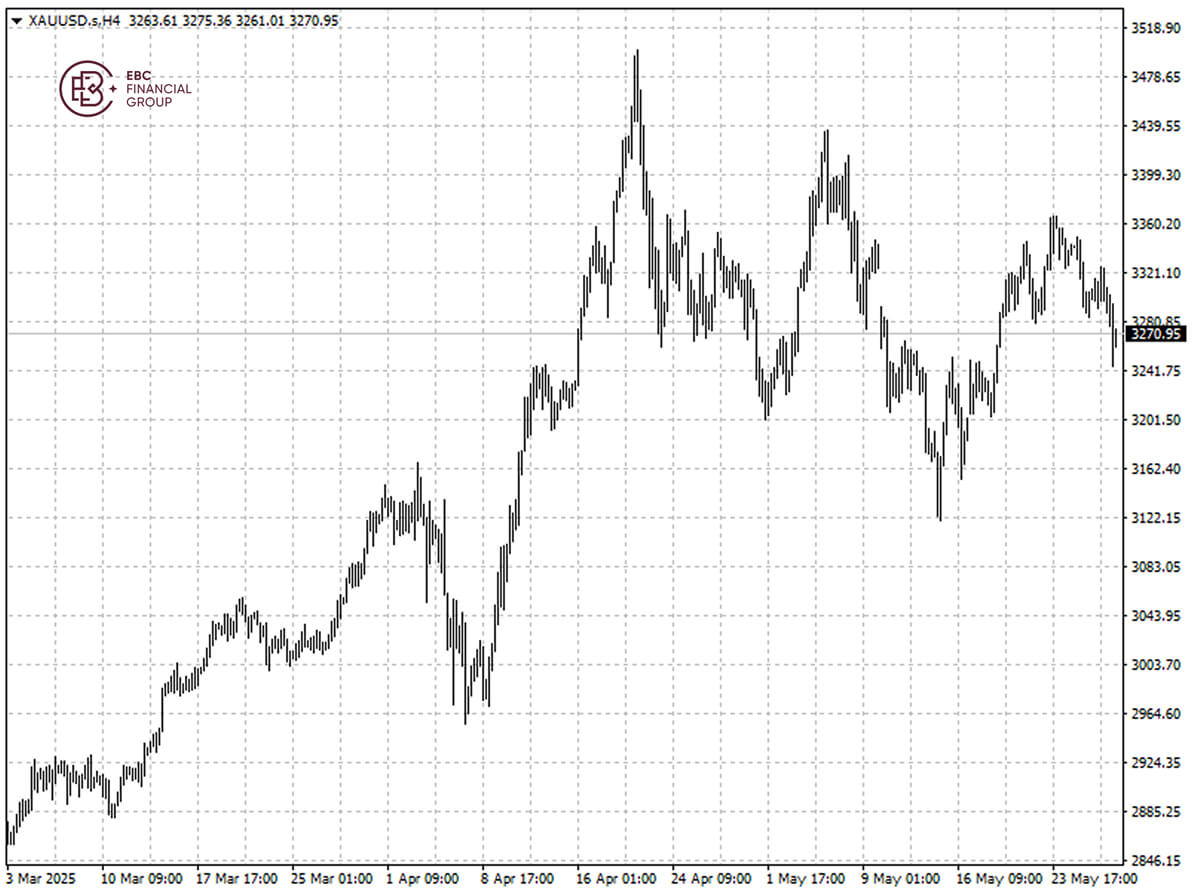

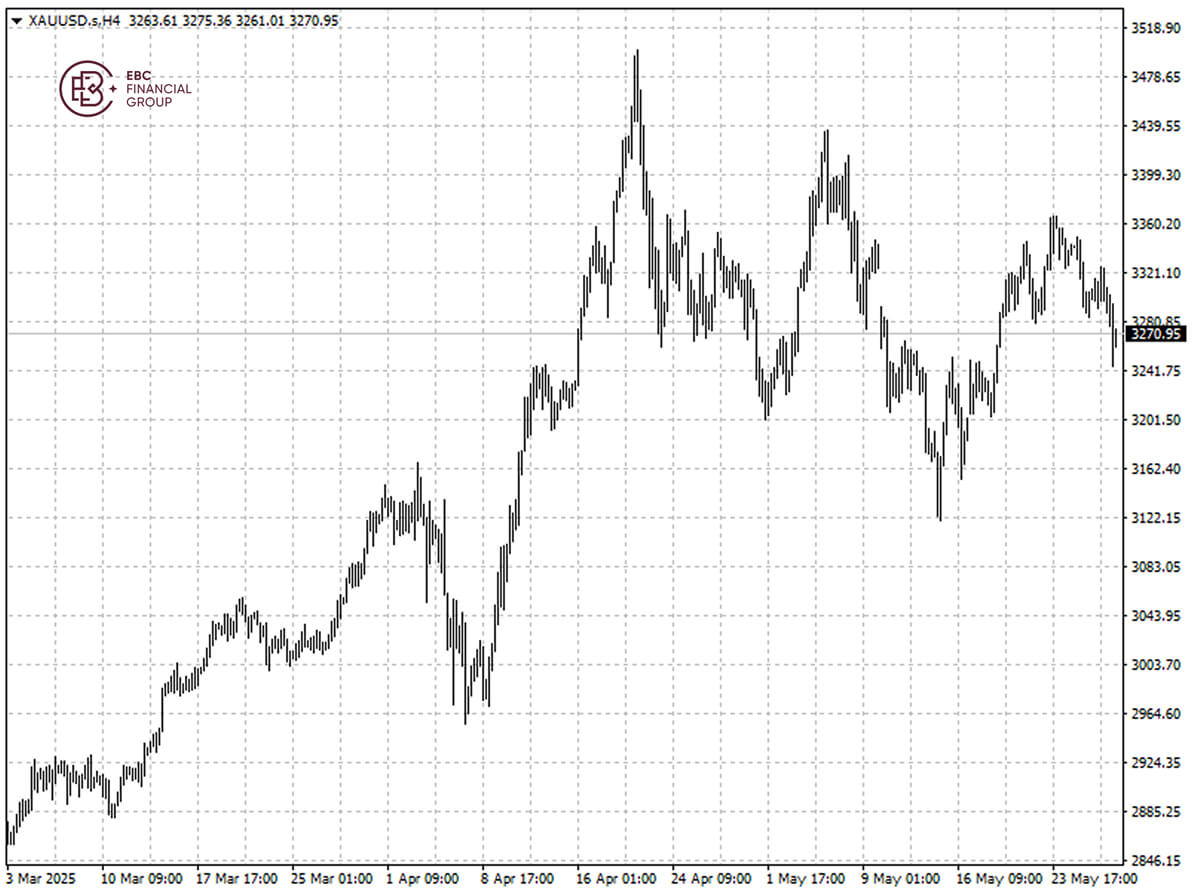

A head and shoulders top pattern bodes ill for bullion's rally. A push below

$3,230 is more likely than not as Nvidia's earnings beat could also dent

safe-haven demand.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.