Using Support and Resistance for Traders

2023-12-26 Summary:

Summary:

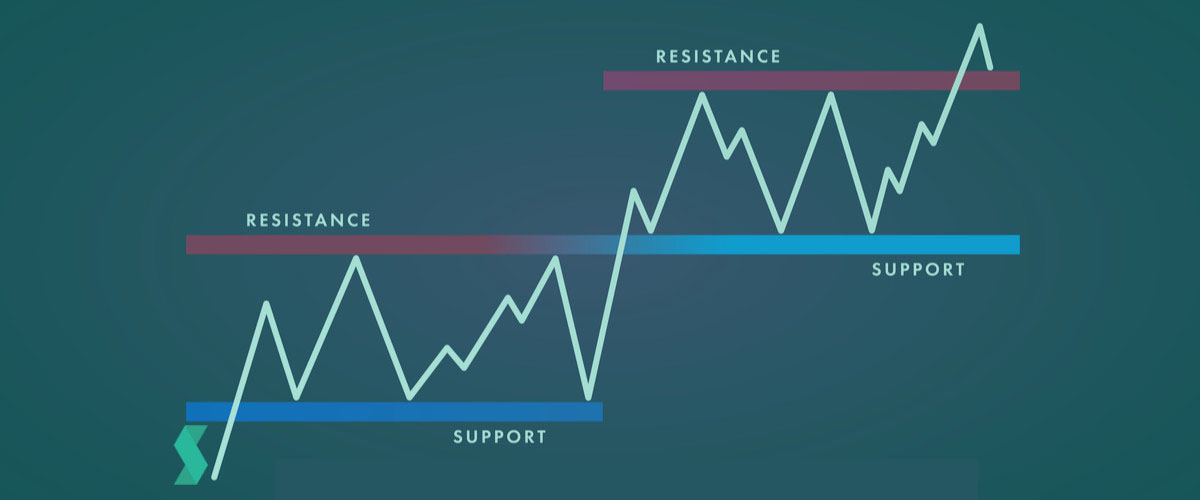

In finance, investors seek strategies for consistent profits. Identifying support and resistance guides entry and exit decisions in the markets.

In the financial market, investors are always looking for a strategy that can make steady profits, and support and resistance levels are important bases for judging entry and exit points. There is a saying: go long at the support level and go short at the resistance level. Using support and resistance to do long and short positions is a core concept that has attracted much attention. The success of this strategy relies on the accurate judgment of market trends and the flexible use of support and resistance. This article will provide an in-depth analysis of this concept to help investors better understand how to seize opportunities in market fluctuations.

Basic Concepts of Support and Resistance

Support and resistance are two basic concepts in technical analysis. They reflect important levels of market price movement.

Support is not a single price point; rather, it is an area that can be described as a support area. This area consists of actual or potential bid prices, forming an area that is strong enough to temporarily arrest price declines. It is important to note that the emphasis here is on temporary suppression, as any support level may be breached.

Similarly, a resistance level is an area, which we can call a resistance area. It is formed from actual or potential selling prices, forming an area where selling is sufficient to prevent a temporary rise in price.

Purely from the definition of support and resistance levels, we should understand why we should go long at the support level because it represents a buying area and go short at the resistance level because it represents a selling area. This understanding can help formulate more informed buying and selling strategies in trading.

Basic principles of Support and Resistance Trading Strategies

Trend judgment: When using support and resistance long and short strategies, you must first accurately judge the market trend. Trend is investors' friend, so when choosing to go long or short, you need to know whether the current market is in an upward trend, a downward trend, or sideways.

The use of support levels: When the market is in a downward trend, support levels become the focus of investors. The support level is often the point where the past price has rebounded. If the stock price falls below the support level, it may mean that the market will fall further, and investors can choose to go short to obtain profits.

Focus on Resistance Levels: Conversely, when the market is in an uptrend, investors need to focus on resistance levels. The resistance level is the point where the price rise has been blocked in the past. If the stock price breaks through the resistance level, it may usher in more buying orders, and investors can choose to go long to make profits.

Response to sideways markets: In sideways markets, the use of support and resistance is equally important. Investors can go long when the price is close to the support level and short when the price is close to the resistance level to make profits from the fluctuations in the consolidation.

Case Analysis

To better understand the application of the long-short support-resistance strategy, let’s look at an example: a stock has been in a downward trend for the past few months, and investors begin to consider whether they should short it. Through technical analysis, they found an obvious support level, and the stock price has repeatedly rebounded at this level in the past, showing strong support for the market.

On this basis, investors decide to wait for the stock price to fall below the support level before entering a short position. Sure enough, when the stock price fell below the support level, more selling appeared in the market, the stock price continued to fall, and investors successfully made profits. This case illustrates the critical role of support levels in short-selling decisions.

Key steps and considerations for using support and resistance to go long and short:

-

Long (Buy) Strategy:

Identify support levels: Use technical analysis tools, such as trend lines, moving averages, etc., to determine the support levels of stock prices. The support level is usually the point where buyers are willing to enter the market when the stock price falls to a certain level.

Confirming the Trend: Confirming that the current market trend is an uptrend makes support more likely to come into play. Make sure the support is where it is in the trend.

Waiting for verification signals: When the stock price is close to the support level, observe whether there is a rebound signal, such as a bullish signal, or a positive line formed by the price near the support level.

Set Stop Losses and Targets: Set clear stop losses when opening a position to control risk. At the same time, setting expected profit targets will help lock in profits.

-

Short (Sell) Strategy:

Identify resistance levels: Use technical analysis tools to identify resistance levels in stock prices. The resistance level is usually the point where sellers are willing to sell when the stock price rises to a certain level.

Confirming the Trend: Confirming that the current market trend is a downtrend makes resistance levels more likely to come into play. Make sure the resistance level is where the trend is.

Wait for verification signals: When the stock price approaches the resistance level, observe whether there are any signs of a pullback, such as a bearish signal or a negative line formed by the price near the resistance level.

Set Stop Losses and Targets: Set clear stop losses when opening a position to control risk. At the same time, setting expected profit targets will help lock in profits.

-

Precautions:

Volume verification: Before executing a buy or sell operation, pay attention to the performance of trading volume. A larger volume helps verify the validity of a support or resistance level.

Cautious Breakthrough: When the stock price breaks through the support or resistance level, you need to confirm whether there is sufficient signal support. Be careful with possible false breakthroughs to avoid misjudgments.

Overall market risk: Pay attention to the overall market risk, including global economic factors, industry trends, etc., to avoid external factors affecting transactions.

-

Risk Management and Mentality Control

Risk management is a crucial aspect when using a support-resistance strategy. Investors need to set reasonable stop-loss levels to prevent uncertainty in the trend after the price breaks through the support or resistance level. At the same time, you must maintain a calm mind, not be swayed by market sentiment, and make rational decisions.

| Long Strategy | Short Strategy | |

| Support Level | Go long at support levels because they represent buying interest. | Not suitable for shorting at support levels as they represent buying interest. |

| Resistance Level | Not suitable for going long at resistance levels as they represent selling interest. | Go short at resistance levels because they represent selling interest. |

| Support and Resistance Strategy | Assess market trend, focus on support levels, choose long strategy. | Assess market trend, focus on resistance levels, choose short strategy. |

| Trend Analysis | Choose long strategy in an upward trend. | Choose short strategy in a downward trend. |

| Use of Support Level | Becomes a focal point in a downtrend for choosing long strategy. | Not applicable for shorting as support levels represent buying interest. |

| Focus on Resistance Level | Becomes a focal point in an uptrend for choosing long strategy. | Becomes a focal point in an uptrend for choosing long strategy. |

| Long Strategy Steps | Utilize support levels, confirm trend, wait for validation signals, set stop-loss and targets. | Not applicable for short strategy. |

| Short Strategy | Not applicable for support levels as they represent buying interest. | Utilize resistance levels, confirm trend, wait for validation signals, set stop-loss and targets. |

In addition, timely adjustment of positions and fund allocation is also an effective risk control method. When the market fluctuates greatly, reducing positions appropriately and retaining sufficient capital reserves can help avoid potential risks. Using support and resistance to go long and short is an effective strategy based on technical analysis. By accurately grasping market trends and key levels, investors can formulate trading plans in a more targeted manner. However, this is not a silver bullet for absolute success. Investors need to continue to learn and practice, sum up experience, and gradually improve their trading skills.

In the future, as the market environment continues to change, support and resistance strategies may undergo new developments and changes. Investors need to constantly update their knowledge system through in-depth understanding of support and resistance strategies and continue to hone them in practice and use them flexibly. Various tools and methods exist to better adapt to market changes, obtain better returns in the complex and ever-changing financial market, and achieve wealth appreciation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

How AI is Transforming the Future of Trading?

See how AI transforms trading with advanced data analysis, automation, and real-time insights, boosting accuracy and market efficiency for traders.

2024-10-29

How to Profit from AI Bots in Trading

Learn how to use AI bots in trading to enhance performance and generate income. Discover strategies for maximizing profits in the financial market.

2024-10-28

Best Currency Pairs for Forex Trading

Maximize your forex trading success by choosing the best currency pairs. Learn why USD, EUR, and JPY are among the most traded and profitable pairs

2024-10-24